Digital Transformation Is Reshaping the Insurance Industry

How the insurance industry delivers service has evolved significantly in the last decade.

Regardless of what form of insurance sales or policy management your organization is engaged in, you can attest that face-to-face interactions are no longer routine and are, in fact, an oddity.

As the insurance industry’s new normal, more and more interactions between customers, industry experts, other organizations, and adjustments claims occur digitally. Though phone-based communications will continue to be a part of the customer service process for the foreseeable future, customers, care providers, other insurers, and virtually anyone else with whom an insurance company interacts have come to expect a largely digitized experience.

For any organization to thrive in the insurance industry of tomorrow, it must take steps to evolve its processes today. That means creating a cohesive modernization strategy and investing in leading-edge technology solutions.

Read more: Answering the Burning Questions of Business Leaders on Digital Transformation!

Top Challenges Facing the Insurance Industry

To understand what a modernized strategy looks like in the insurance industry, it’s vital to examine some of the top challenges businesses will face in the coming years.

1. Staffing Shortages

Historically, the insurance sector has contended with turnover rates somewhere in the range of 8-9%, according to Insurance Business America, but that span climbed to 12-15% by September 2022.

That additional turnover significantly impacts business continuity and diminishes the customer experience. It can also negatively influence insurers’ ability to replace members of leadership that are retiring or stepping away from the industry.

2. Skyrocketing Costs

Inflation and numerous other factors have contributed to rising costs of everything from healthcare to vehicles higher than ever before. Naturally, some of these cost increases are passed onto insurers and their customers, so insurance companies must find ways to absorb some of these expenses while mitigating rate increases for their clients.

Insurers should also explore ways to reduce their operating costs to keep coverage prices lower. Otherwise, businesses may find it challenging to retain customer accounts, particularly in sectors like automotive insurance, where consumers can freely shop around and change policies in six-month intervals.

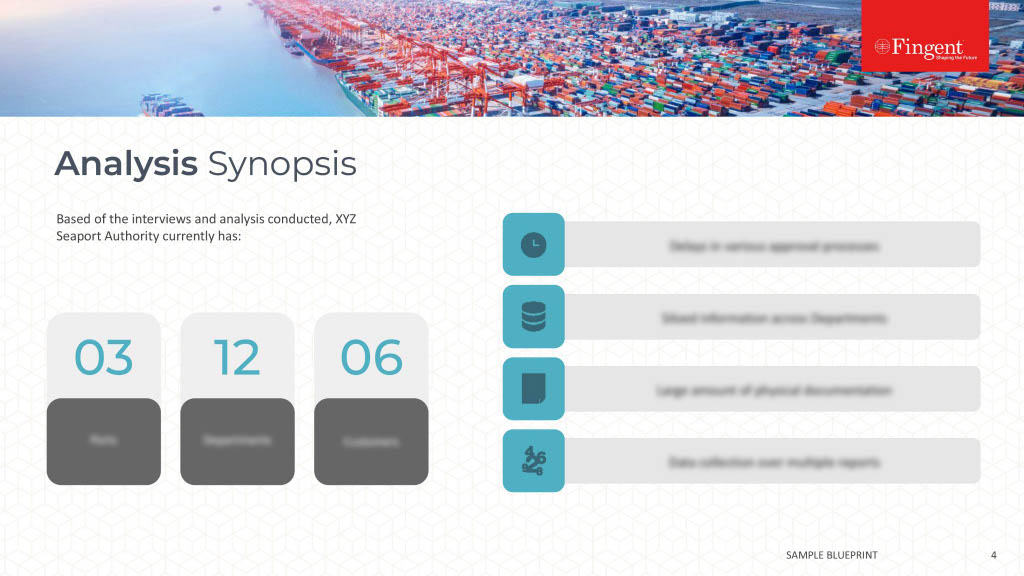

3. Antiquated Legacy Systems

Some legacy systems hinder the ability of many businesses to embrace digital transformation. These aging platforms can make it challenging to comply with relevant regulatory requirements and increase an organization’s overall operating costs.

The longer that insurance companies cling to antiquated systems, the harder it will be for them to streamline traditionally tedious practices, such as claim management. Therefore, insurance companies must replace these inefficient, disjointed platforms with modern, unified alternatives.

The Role of Digital Transformation in Solving These Challenges

Digital transformation can bring modern technologies to any business process to improve its operation. Fast-growing digital transformation technologies include machine learning, artificial intelligence (like ChatGPT), customer relationship management platforms, and intelligent document processing software.

Digital transformation holds the key to solving the insurance industry’s most significant problems, and it appears that many in the industry realize this, as recent projections estimate that insurance technology spending will increase by 25% between 2022 and 2026 in the US and UK.

A cohesive digital transformation strategy will lay out a roadmap for replacing aging technologies with modern alternatives, and once these technologies have been replaced, the cost savings are almost immediate.

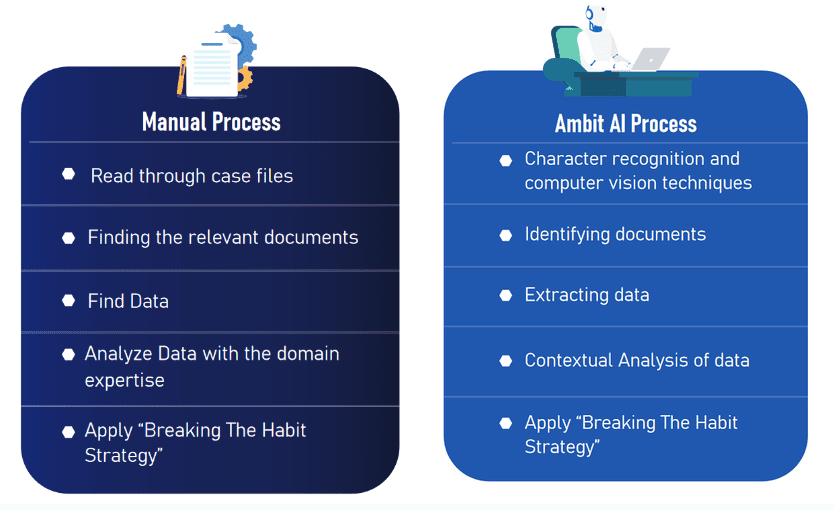

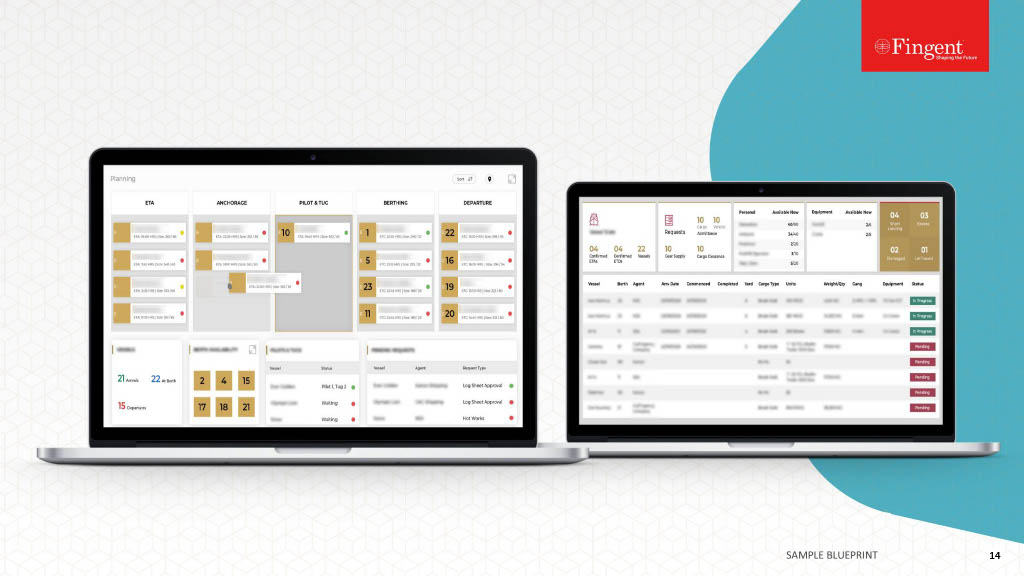

In one example of how a digital transformation strategy led to practical innovation, Fingent joined forces with the California law firm of Sapra & Navarra, LLP to develop Ambit, an AI and ML program that simplifies and enhances the management of workers’ compensation claims. Claims may include hundreds of pages consisting of a variety of letters, affidavits, forms, and other documents from claimants, doctors, lawyers, investigators, employers, and witnesses, among others. Utilizing both artificial intelligence and machine learning, the Ambit system streamlines the claims management process, reducing claim costs, and helps break the old practices of:

- Taking too long to assess claims

- Treating similar claims inconsistently

- Not equipping claim adjusters with modern tools

Instead, Ambit improves the efficiency of all parties — insurance carriers, self-insured companies, lawyers, and claim adjusters — while reducing costs for insurers by 57%.

The Ambit solution was designed to:

- Easily ingest the many documents in the claims process

- Quickly identify missing, processed & corrupted pages

- Review structured and unstructured documents automatically

- Identify areas of concern

- Suggest potential legal defenses

- Automate calculations and reminders for important legal deadlines

- Generate case summaries, with action plans

These automation capabilities not only make life easier for claims managers but enable organizational leaders to offset productivity issues created by ongoing labor shortages by reducing onboarding time for new hires. These capabilities result in more uniform handling of the claims while speeding their resolution and lowering their overall costs.

In general, automation technologies, such as those implemented during a digital transformation initiative, will also decrease operating costs, enabling insurance companies to increase their profitability and offer their customers more competitive premiums.

Read more: How AI Drives Digital Transformation In The Insurance Industry

The Essential Components of Digital Transformation

The technology trend in insurance is clearly moving from the strictly paper-based methods of the past to the digital. Beyond static websites to mobile apps. Beyond email to text and chat. Beyond processes driven by people to more and more intelligent automation that speeds up and uniformly handles all kinds of processes from marketing, and operations, to customer service.

Every organization’s digital transformation roadmap should be as unique as the business itself, but every digital transformation strategy must include a few core elements:

- Clear objectives

- An integrated plan

- A leadership-driven approach

- Investments in the right technology

When creating your organization’s digital transformation strategy, you should start by defining your “why.” In other words, you must identify the reasons you are undertaking this initiative in the first place.

From there, work with a digital transformation partner who can help you create an integrated plan that includes everyone from executive members to line-level employees.

Digital transformation efforts — even small ones — require the active support of top management. Change is the hardest thing to achieve in the organization and without the sponsorship of the corporate leaders, the effort is unlikely to succeed.

Finally, you will need to replace outdated, inefficient technology with modern, robust solutions. When appropriate,

partner with a custom software development firm that can provide you with a purpose-built solution you need for your business. They are equipped with the personnel and experience to generate a solution in the minimum timeframe and without the need to increase in-house headcounts.

If your organization has been exploring ways to improve the customer service experience, increase productivity, improve profitability, and streamline its operations, it is more than ready to embrace digital transformation.

Successfully facilitating digital transformation requires a cohesive strategy, some cutting-edge technologies, a commitment to doing things better, and the right development approach.

Read more: Digital Twin Improving Predictability and Risk Management in Insurance!

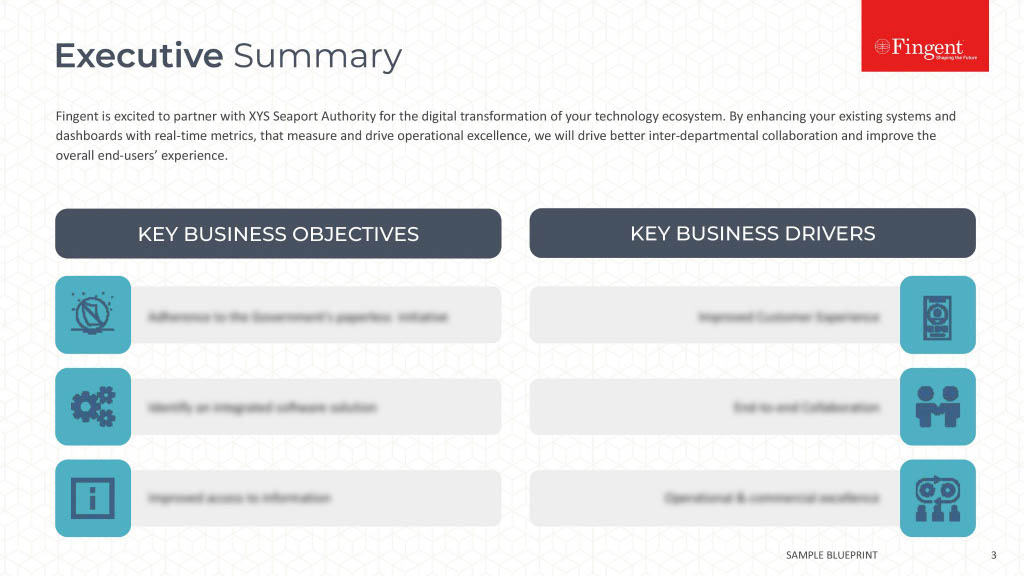

How Fingent Can Accelerate Your Process

Naturally, the cornerstone of any digital transformation initiative is technology choices. These may be an off-the-shelf system for standard processes, the integration of existing systems or, your transformation may demand a custom solution that can accommodate your business needs unlike systems available to anyone else.

At Fingent, we specialize in creating resilient custom software solutions that are able to change and adapt according to your requirements. We work with insurance industry clients to help them streamline mission-critical business processes, and – as in all our projects – we accomplish this by providing dynamic, unique software that incorporates the most appropriate technology, such as the latest in machine learning and artificial intelligence technologies.

Connect with Fingent today to accelerate your digital transformation with the help of an experienced software development partner.

Stay up to date on what's new

Recommended Posts

03 Jul 2024 Financial Services

AI in Business: Preparing Leaders For The Revolution

AI in Business is a present reality! It’s a building revolution that is all-encompassing and is redefining business operations. You have only two options. Either ride on the crest of……

20 Jun 2024 Healthcare B2B

AI in Healthcare: Enhancing Patient Outcomes and Experience

Artificial Intelligence is a multi-talented assistant and has proven its worth in the healthcare industry. Healthcare organizations have found innumerable ways to use AI, from record maintenance to patient assistance.……

08 May 2024 Financial Services B2B

AI in Financial Services: Use Cases and Applications

Achieving perfection is no easy process. It is not impossible either. It takes a lot of effort and hard work but with the help of Artificial Intelligence, this process can……

24 Apr 2024 B2B

A Leader’s Blueprint for AI Success

How are Businesses Using AI? The verdict is crystal clear—leaders today must embrace AI solutions to stay ahead of the curve and survive in the rapidly evolving business landscape. AI……

Featured Blogs

Stay up to date on

what's new