AI in Financial Services: Use Cases and Applications

Achieving perfection is no easy process. It is not impossible either. It takes a lot of effort and hard work but with the help of Artificial Intelligence, this process can become a lot smoother. AI has undoubtedly proved itself in innumerable industries, and the financial market is no different.

With AI, Financial sectors are seeing a massive transformation in how they work, process documents, make decisions, predict market changes, and even mitigate risks.

As Dan Schulman, the CEO of PayPal once said, “We’re not trying to reinvent the wheel; we’re trying to perfect it.”

In this blog, we will learn how Artificial intelligence is shaping the future of financial services.

What Does Artificial Intelligence Mean to the Financial Service Sector?

First, it’s imperative to understand the relationship between Artificial intelligence and finance. Almost all major banks state that they use AI for various functions. It supports financial services like automated customer assistance, risk management, and fraud detection. Research shows that machine learning makes up about 18% of the banking, financial services, and insurance market.

With the assistance of AI, banks can perform a wide range of functions, including real-time performance forecasting, detection of odd spending patterns, and compliance management. This enables them to streamline and automate mundane manual processes and boost efficiency.

With machine learning, AI can evaluate large amounts of data to discover trends and form predictions. This allows investors to track investment growth and beware of risks.

A Comprehensive Guide: Leader’s Blueprint For AI Success

Top Functions That Artificial Intelligence Can Improve

1. Fighting Fraud

Ensuring the proactive protection of financial assets remains paramount for customers. It instills a sense of confidence and satisfaction in their investments. Artificial intelligence can help here. It analyzes a person’s buying behavior and notes their spending patterns. Something that seems out of the ordinary triggers an alert in the fraud detection systems.

Machine learning algorithms can easily detect fraudulent patterns and actions. This helps financial institutions take preventive measures to tackle financial crime. According to recent research, AI-driven systems have detection accuracy rates of up to 95%! Traditional systems normally range between 60-70%. That’s a significant increase.

Case study:

Companies like PayPal and Square leverage artificial intelligence well. AI algorithms track transaction patterns and detect suspicious activities that may signal fraud. These ML systems improve with time as they continuously learn from new data, enhancing their performance.

2. Risk Management

Addressing potential threats before they escalate into real issues. This is the secret to resolving most business challenges.

Risk management programs can be run through AI risk assessment, prediction, and mitigation. This encompasses credit risk, identifying fraud, and monitoring compliance. This will improve risk management procedures and lower the odds of suffering financial losses.

Predictive analytics enabled by Artificial Intelligence can enable proactive risk management techniques. Businesses can predict market movements and detect possible dangers before they occur. In this way, AI helps improve risk management methods, make better decisions, and build resilience, which is vital in an ever-changing financial world.

Case study:

JP Morgan used a machine learning system nicknamed LOXM (Deep Learning and XVA). It can forecast market risk indicators, including interest rates and credit spreads. LOXM enhanced the accuracy of market risk projections manifold. It achieved this by adding non-linear correlations and intricate interactions between variables. This allows traders and portfolio managers to make better investment decisions.

3. Personalized Customer Service

Everyone likes to feel special to have a service customized especially for them. As a service provider, your top priority will be to fulfill this desire. By providing individualized customer care, you can display your loyalty, care, and business success. A recent Epsilon survey shows that “80% of customers feel more compelled to engage with a service when they receive customized offers.”

Chatbots and virtual assistants powered by AI are remarkable tools. They offer individualized customer care, resolve inquiries, and assist with budgeting. They do this with the backbone of Natural Language Processing (NLP) algorithms. These algorithms analyze consumer sentiment and organizational feedback. This leads to improvements in service quality and an improved customer experience.

Read more: AI in the banking sector

Artificial intelligence can also provide personalized recommendations for financial assets and services. This includes investment possibilities or insurance plans. These will be based on the customer’s taste and financial goals. Which in turn are retrieved through consumer data analytics and transaction histories.

This way, AI can enhance the whole customer experience, develop loyalty, and increase engagement. This will eventually boost market growth and competition. A report by McKinsey showed the results of banks that use customized product suggestions. They saw a 20-30% improvement in conversion rates!

Case study:

USAA introduced Nina, an AI-powered virtual assistant. It provides individualized customer care via voice and text interactions. Nina uses NLP algorithms to comprehend natural language inquiries. It then delivers appropriate information and support. Thus improving the entire customer service experience.

4. Quicker Document Analysis

Managing and extracting value from massive volumes of unstructured data isn’t an easy task. AI, Natural language processing (NLP), and optical character recognition (OCR) help in this. Data is extracted and organized efficiently, which leads to efficient document arrangement and analysis.

According to research, mortgage applications and loan approval times have been reduced by 30-50%! This is achieved by integrating AI into loan processes.

With AI as the backbone, you can monitor compliance by guaranteeing adherence to regulatory standards. How is this done? AI-powered systems meticulously scan documents to verify compliance with organization rules. The company thus avoids penalties and regulatory hurdles. AI improves contract management by identifying essential words, clauses, and contract hazards. This empowers institutions to make more informed decisions during negotiations and monitoring.

Read more: Business Intelligence in Financial Services

Case study:

An AI-powered digital lending platform automates the loan origination process by collecting data from borrower documents and generating loan applications. Such a platform decreases human data entry and processing delays, helping lenders speed up loan approvals while improving the entire client experience.

5. Speed

“Time is money” is an age-old proverb that resonates greatly in our modern era. The need for increased speed in the financial services sector is more urgent than ever. What will help you achieve that delicate balance between speed and efficiency? This is where AI emerges as the protagonist, offering unparalleled solutions.

Speed is the cornerstone of AI’s transformative impact on the financial services landscape. Empowered by AI-driven algorithms, financial institutions can execute trades and process transactions quickly, allowing them to capitalize swiftly and efficiently on market opportunities.

AI-driven trading systems use present criteria and market data to trade. This is way faster than humans, thus boosting efficiency and cutting costs. According to research, the Algorithmic Trading Market was valued at USD 14.42 billion this year. It is predicted to grow at an 8.53% CAGR! Why such unprecedented growth?

AI algorithms rapidly analyze vast real-time data. This superpower provides rapid market insights for agile decision-making and adaptation. It swiftly assesses and mitigates hazards with real-time data and market dynamics, enhancing risk management.

Case study:

Fingent helped develop Ambit. A customized AI machine-learning solution that simplifies and speeds up the claims management process. The client, Sapra & Navarra, have found refuge in the solution to ease the settlement process, improve the performance efficiency of lawyers, and transform client experience.

AI Cuts Average Case Settlement Time to 1-2 Days

6. Report Generation

As per a study conducted by McKinsey, AI boosts the global banking sector’s value by $1 trillion each year! This is due to its ability to enhance decision-making skills through intelligent reports.

AI-generated reports greatly empower financial institutions to deliver short, accurate, and insightful reports. This enhances operational efficiency, compliance, and stakeholder engagement, thus refining decision-making capabilities.

Artificial intelligence has revolutionized financial report generation by automating data analytics and customization. It speeds up the process by retrieving data from multiple sources, formatting it, and creating reports. It gives users the option to customize and personalize reports, which helps better match customer needs and tastes.

Natural Language Generation (NLG) technology has also been a great complement to AI. They aid communication by converting data and insights into understandable reports. AI also streamlines compliance and regulatory reporting. By automating report creation and updates it helps ensure adherence to evolving regulations.

Case study:

AI-powered portfolio reporting solution that assists financial professionals in creating meaningful insights and suggestions for their customers. This is achieved by compiling data from many sources and using advanced analytics. Asset managers and wealth advisers can thus generate individualized performance reports for customers.

AI Changes the Game

Artificial Intelligence emerges as a game changer in the financial services world. With its revolutionary power, it disrupts traditional models. Machine learning, natural language processing, and computer vision enhance its capabilities. These are strategically applied to produce real benefits for banks. These benefits range from boosting staff and customer experiences to back-office processes.

In summary, what can AI enhance? It can create and evaluate new ideas, conduct analyses, and enhance decision-making. AI enables faster prototyping and risk analysis. It not only improves operational efficiency but also provides personalization to financial institutions.

You will have to decide to transition into this environment sooner or later, which makes it vital to find an efficient partner. A good track record and transparent communication are assets that must be on your list.

Deliver Top-Notch Banking Experiences to Your Customers!

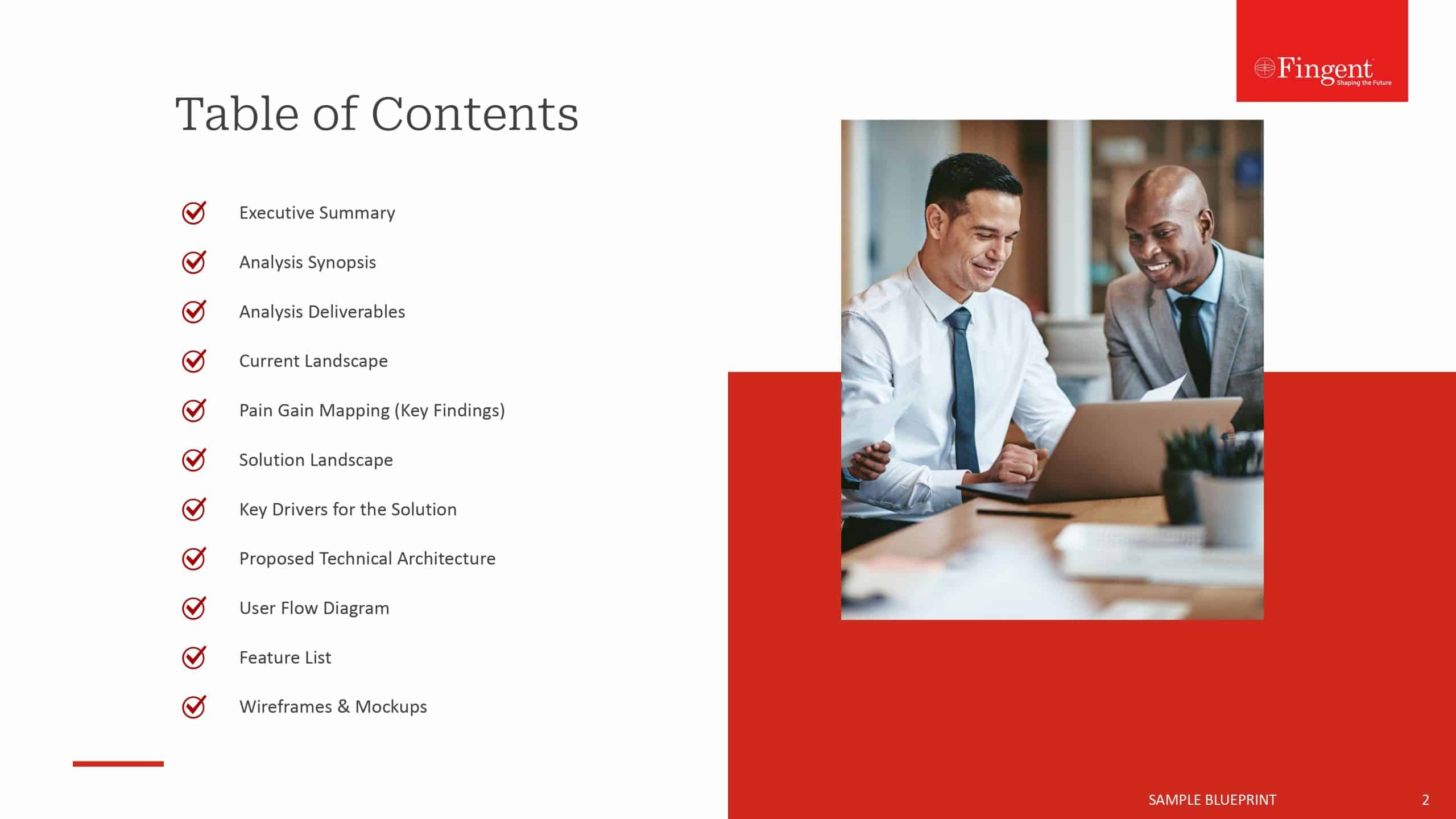

How Fingent Can Help

Fingent is one of the world’s largest software solution providers. We have a track record of delivering personalized AI solutions to our clients.

A few success stories:

Top-Notch Plugins to Improve Customer Experience

Fingent is in collaboration with Mastercard to develop and maintain cutting-edge plugins. The goal is to improve customer experience. This benefits support staff and the merchants using the Mastercard Payment Gateway Services.

Processing Workers’ Compensation Claims Made Seamless

Processing workers’ compensation claims can be a tedious task. Fingent created unique Al software to improve and accelerate the associated procedures. It uses Optical Character Recognition (OCR) and Al to enable intelligent data extraction and contextual analysis. This helps in deriving valuable insights from bigger datasets.

This demonstrates our ability to utilize intelligent technology and new business models. Our team has experts in neural networks, natural language processing, and machine learning. They will work together to ensure that you get the best possible outcomes.

If you are looking for a capable partner to enhance your business model, look no further! We are here, and we are ready to help!

Stay up to date on what's new

Recommended Posts

12 Feb 2026 B2B

AI System Integrators — The Key to Enterprise-Ready Intelligence

AI is everywhere. Most businesses are trying it out. Very few manage to make it work. Fewer succeed in scaling it effectively. You can be one of the few. How?……

16 Jan 2026 Financial Services

The Role of AI in Financial Risk Management

Risk is everywhere in finance. Markets move. Competitors shift. Regulations change. Customers default. Economic conditions surprise. Every single day, financial institutions face decisions that could cost them— or save them—……

03 Jul 2024 Financial Services

AI in Business: Preparing Leaders For The Revolution

AI in Business is a present reality! It’s a building revolution that is all-encompassing and is redefining business operations. You have only two options. Either ride on the crest of……

20 Jun 2024 Healthcare B2B

AI in Healthcare: Enhancing Patient Outcomes and Experience

Artificial Intelligence is a multi-talented assistant and has proven its worth in the healthcare industry. Healthcare organizations have found innumerable ways to use AI, from record maintenance to patient assistance.……

Featured Blogs

Stay up to date on

what's new