GST in SAP: Essential Things to Know Before Implementing

Goods and Services Tax (GST) is now a fait accompli. GST would amalgamate various Central and State taxes into a single tax, mitigate cascading or double taxation, and facilitate a common national market. While the simplicity of the tax leads to easier administration and enforcement, enterprises have a tough time transitioning to the new system. The old taxes would be halted on the last day, and the GST would go live the next day.

Need help with integrating GST on your SAP implementation? Click here to setup a free discussion with our SAP experts.

Enterprises need to start the transition process well ahead of time, to avoid chaos and confusion, and make sure they are compliant with GST from the word go.

Get the Systems in Place

Regardless of the industry or sector, any business is likely to have a unique journey for GST implementation. However, a common thread underlying the journey would be the readiness of IT systems and procedures.

GST is business driven. If enterprises have not already got rid of their manual ledgers and vouchers, there is no longer an escape. Achieving GST compliance will be impossible without a sound technical backup, which would include digitization of all records and automation of the processes involved in the transactional systems. If nothing else, the GST assessee is required to file multiple returns involving sales and purchase of goods and services, and it is practically impossible to maintain all these returns manually. There is no workaround to automating the system and making the system compliant with GST.

GST is business driven. If enterprises have not already got rid of their manual ledgers and vouchers, there is no longer an escape. Achieving GST compliance will be impossible without a sound technical backup, which would include digitization of all records and automation of the processes involved in the transactional systems. If nothing else, the GST assessee is required to file multiple returns involving sales and purchase of goods and services, and it is practically impossible to maintain all these returns manually. There is no workaround to automating the system and making the system compliant with GST.

Upgrade SAP and Get it Ready

SAP India is getting ready with GST related changes in their products. The exact nature of the changes would obviously be not explicit until the GST law actually comes to pass. However, there are certain prerequisites to meet, which can be done now, before GST comes into effect.

For starters, businesses would have to upgrade to the relevant version of SAP. Businesses would also need to deploy an enhancement pack and service pack as part of this readiness. The necessary minimum patch level for SAP application, for GST, is SAP ERP 6.0 (600) SP26 or higher.

Need help implementing GST on your SAP software?Click here to get in touch with us for a quote.

GST related changes done by SAP are based on TAXINN concept of tax determination. Businesses still using TAXINJ concept of tax determination will have to migrate the SAP system from TAXINJ to TAXINN. TAXINN is a condition based procedure whereas TAXINJ is a formula based procedure. Migrating the SAP system from TAXINJ to TAXINN is a mini-project in itself, and may require anywhere between three to six months, depending on the complexities involved.

Businesses would also need to make the following specific changes.

- Master Data Set-up: Create or update the master list of vendors, customers, materials, and services. The master data will have a major impact on GST, and successful GST migration and implementation requires getting the master data ready well before the GST start date.

- Destination Set-up: Create a business place for each area of operations, and assign to plants. The GST tax regime has “place of supply,” where the taxation will be determined.

- Tax and Pricing changes: Set up the required adjustments in tax procedures and pricing procedures

- RICEFs: Make sure the necessary forms, layouts, and modifications to EDIs are in place. Upload the required programs well in advance, as soon as it becomes available.

Since the final GST law is not yet enacted, and the rules yet to be framed, SAP has been releasing SAP notes based on the draft Model GST law SAP has already released Notes for DDIC changes, Screen Changes, Master Data and transaction data, and some other facets of GST. Businesses need to track and install the requisite notes and follow the manual correction parts. A certain level of customization would be required, according to the business process.

The full list of released SAP Notes for GST may be found here.

Backend online support/integration

Businesses with GST registration need to connect SAP to GSTIN, the online portal that serves as the central console for all activities such as tracking of transactions, making input and output credits, the filing of returns, and payment of taxes. SAP would be providing the required interfaces to upload the invoice in the GST network.

Make Necessary Tweaks to the Business Processes

Businesses would also have to make some changes in their business procedures, if not already following the recommended procedures, and such changes would have to reflect in the ERP suite.

Some of the tweaks required would be:

- Reconfiguring tax computation procedures based on the new rules

- Refining all tax-related outward and inward business processes

- Adopting sequential numbering for outgoing invoices

- Adhering to the new reporting and printing structure

Here are some of the changes, based on the Model GST Law, for which businesses would have to be prepared, and tweak their business processes.

Deploy a System for Input Credits

GST levies and collects tax at each stage of sale or purchase of goods or services, based on the input tax credit method. GST registered businesses may claim a tax credit to the value of GST they pay on the purchase of goods or services.

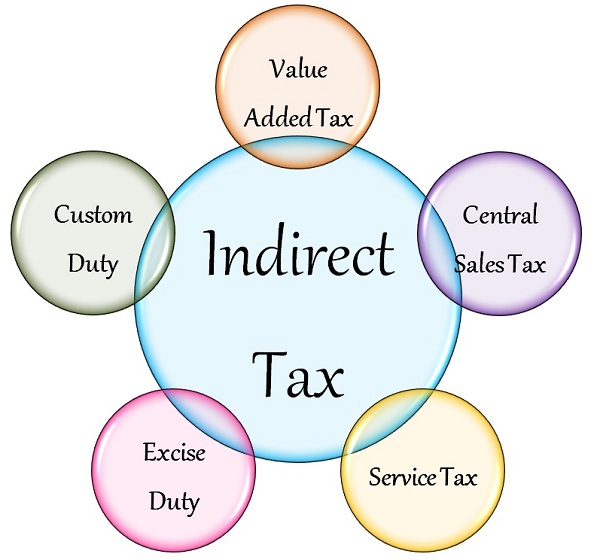

The main task with GST is the adjustment of input credits available for the purchase of inward goods and services against the sale of goods and services. The present system is a hodgepodge of different Input and Output accounts for various taxes such as VAT, CST, Service tax, Various Excise duties, Additional Duties of Customs, CVD, etc. The complicated CENVAT credit rules, factoring these different input and output accounts, will no longer be required. The multiplicity of central and state indirect taxes, such as Service Tax, Value Added Tax, Central Sales Tax, Central Excise Duty, Octroi and Entry Tax, Additional Customs Duty (CVD), Special Additional Duty of Customs (SAD), central and state surcharges and cesses, and more, will be subsumed in only three taxes: SGST and CGST on intra-state supply of goods and services, and IGST (to centre) for inter-state supplies.

- Input SGST will be available for set off against output SGST and output IGST.

- Input CGST will be available for set off against output CGST and output IGST.

- Input IGST is allowed for setoff against output IGST, CGST And SGST.

- Also, cross-setoff between goods and services will also be allowed

Under GST, all accounting systems would require only six accounts for credit collection and set off.

Get the Tax Base and Rate:

The first step is to identify the tax base, or whether the product or service is covered under GST. Most products, with the notable exclusion of petroleum products, are under GST though. Post GST, just about all transactions except salaries, banking receipts and payments will come under the scope of GST.

The next step is to identify the tax rate. The GST Council has recently fixed the tax rate for 1211 items, under 98 categories of goods. The standard GST rate of 18% applies to most items, though there are Nil, 5%, 12%, and 28% rates applicable as well. Businesses need to be double sure as to which rate their products and services apply. There is also the minimum threshold of 20 Lakhs turnover to consider.

SAP is the market leader in ERP solutions, but the solution is only as good as the implementation. Leaving gaps in the value chain can lead to the system breaking down and going awry, and the ensuing mess can even lead to the closure of operations. Make sure to cover all the bases now, before GST finally kicks in.

Are you looking for a reliable SAP partner to implement these changes on your SAP program? Click here to setup a free discussion with our SAP experts.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new