2003

Year of Establishment

100s

of Customers Worldwide

4.9/5

Customer Rating

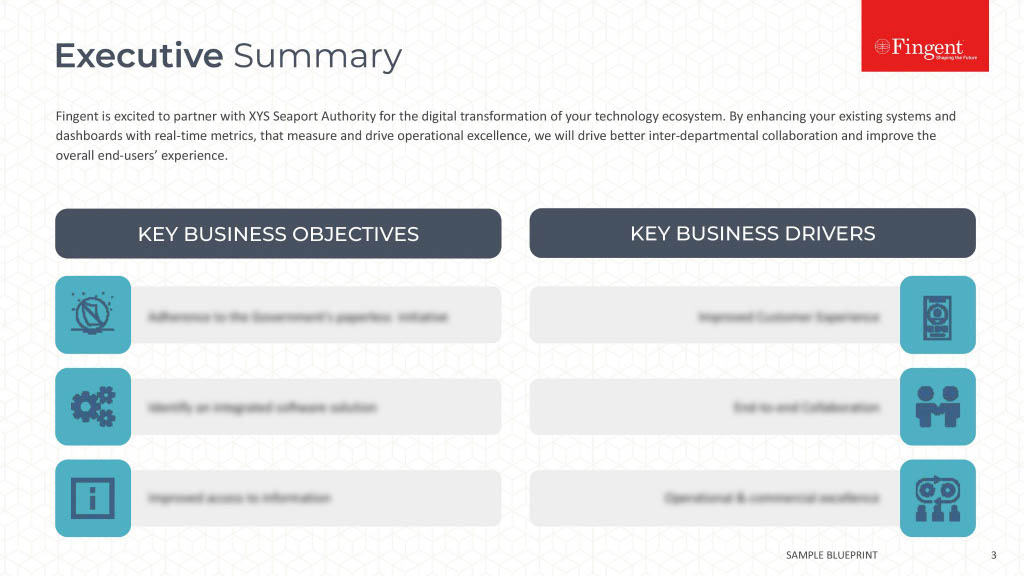

How Fingent Helps

With business risk increasing exponentially, regulations evolving constantly, and non-compliances being dealt more severely, it has become crucial for organizations to gain and maintain a robust risk and compliance strategy. We work with you in creating a solid foundation for risk management while minimizing the cost of compliance and ensuring business continuity.

Experts at Fingent help you build and deploy risk management tools that are scalable and tailor-made for your business. We help you build a risk management structure that will stand the test of time.

Our Risks and Compliance Services

Enterprise Risk Management

Contract Management Services

Regulatory and Compliance

Expert IT Advisory Services

Enterprise Risk Management

We help you incorporate a consistent and structured enterprise risk management (ERM) process across your organization. By this, we ensure that your business is on the ball when it comes to assessing business-critical risks and developing continuous and effective risk management processes.

Contract Management Services

Contractual commitments could translate into millions of dollars if regulatory compliances are not adhered to. We help you develop an automated contract management framework that is built on accountability and continuous improvement so you can rest easy and increase operational efficiency.

Regulatory and Compliance

We equip you with a resilient automated compliance framework created by a dedicated team of specialists highly experienced in ensuring adherence to GDPR, HIPAA, and data privacy laws. We ensure that you have comprehensive coverage of the entire compliance process to keep your business protected and efficient.

Expert IT Advisory Services

Experts at Fingent will help you navigate the ever-evolving world of technology and cyberspace. We help you with cybersecurity, business continuity management, risk management and controls architecture, and everything else that you need to ensure growth and efficiency.

Why Industry Leaders Trust Our Compliance Solutions

Consistent high-quality results with robust agile teams and dedicated QA practices

Highly cost-effective and best-of-breed solutions with no last-minute surprises

Transparent project management with maximum adherence to deadlines

Our Unique Approach & Process

By initiating your project with Fingent, you get a dedicated and skilled team backing you up round-the-clock. All our processes are customer-oriented, designed to reduce the cost of business operations, address IT resourcing challenges, and offer you a competitive edge. We start with a deep analysis of your requirements and continue our relationship with post-launch support and updates.

1

Research and Discovery

2

Validating and Shaping Idea

3

Design and Prototyping

4

Development

5

Testing and Quality Assurance

6

Maintenance and Support

Contact Us

Hundreds of leading businesses have derived strategic advantages from our transformative solutions.

The entire engagement was completely transparent and very systematic. It’s been an exceptional working experience.

Their team is completely committed to our success as a client, and they do that with their dynamic team.

They’ve also been great at meeting the needs of our timeframe versus theirs.

They go above and beyond what the typical developer interaction would be.

They were highly responsive to our needs.

We found their project management solid.

Reviews from engineers testify that their code was consistently solid and comprehensively documented.

I have been very pleased with Fingent Corporation’s user experience and design capabilities.

Fingent’s project team demonstrated passion and commitment throughout the dev cycle and it was very evident in their work.

They’re an honest company to deal with … they were always fair and reasonable.

FAQs

Risk Management is the identification, analysis, and response to risks that may hinder the objectives of the organization. Risk Management needs to be a continuous process, where risks are identified and mitigated at the earliest before they could become a threat to the organization. Risk Management creates a secure work environment, decreases legal liability, and protects assets giving the business stability and confidence to make decisions.

Compliance involves conforming to stated requirements like laws, policies, regulations, contracts and business strategies. Noncompliance is a serious issue and could be costing businesses up to $14.82 million annually along with loss of reputation and customer trust. Though regulatory change has been one of the most serious concerns for compliance officers, there are many other factors like cyber-resilience, personal accountability, and culture and conduct risk, which need to be considered and dealt with to ensure compliance.

The Open Compliance and Ethics Group (OCEG) defines GRC as “the capability, or integrated collection of capabilities, that enables an organization to reliably achieve objectives, address uncertainty and act with integrity; including the governance, assurance, and management of performance, risk, and compliance.” This includes understanding and prioritizing the expectations of stakeholders while optimizing risk profiles, and ensuring that the business is operating within legal, internal, contractual, and ethical boundaries.

The presence of multiple legislations and regulators with changing laws and compliances, fragmented and inadequate reporting, lack of structured risk mitigation policies and SOPs, anti-money laundering (AML) and sanctions compliance are some of the many challenges that businesses face while trying to control risk and reduce non-compliance.

A mature risk management culture with business ownership and participation is essential for the success of any risk management and compliance program. Fingent helps nurture this culture by helping you integrate the principles of GRC across your organization. Using automation, top-notch technology and consultation from our experts, your business will be able to manage risk and compliances effectively.