Category: Digital Transformation

All businesses are built on data. But the question is: Is your business truly driven by data? Or are you merely gathering data without a strategy? An effective Data Engineering strategy might be the key to standing out in the market instead of lagging behind.

Let us help you find out.

Data Engineering: The Backbone of Modern Business Intelligence

In a data-driven age, where information is currency, the businesses that harness data are the only ones staying competitive. Raw data can be a terrifying nightmare because it can be messy and disorganized. Above all, you will find it nearly impossible to uncover valuable insights. That’s why you need Data Engineering.

Drive Business Excellence with Intelligent Data

Harness Data Engineering for Boosted Operational Success

What is Data Engineering?

Simply put, Data Engineering is all about creating, building, and maintaining systems. It enables you to collect, store, analyze, and separate relevant data. In other words, it refines raw data into a more digestible form. This allows you to now harness its power to its full potential. Without this crucial step, businesses are left drowning in a sea of digital clutter. They miss out on valuable opportunities for growth and innovation.

If you want to unlock the true potential of your data assets and stay ahead of the competition – let data engineering pave the way for success.

Why Is Data Engineering a Big Deal?

The significance of Data Engineering solutions has escalated with the exponential growth of data. Every email, customer interaction, and IoT sensor signal contributes to the data wave companies need to handle. A report from Market Data Forecast indicates that the worldwide big data and data engineering services market is anticipated to grow to around $325 billion by 2033, increasing from $75.55 billion in 2024.

Without Data Engineering solutions, companies are overwhelmed by information and unable to derive value from it. With data engineering, they achieve clarity, efficiency, and a competitive edge.

Here’s what it accomplishes:

- Arranges and tidies data so that companies can effectively utilize it.

- Streamlines data processes, minimizing manual work and mistakes.

- Combines various sources for a comprehensive business perspective.

- Enhances storage and processing, reducing expenses and increasing efficiency.

- Ensures security & compliance because no one wants a data breach headline.

Now that we get the “why,” let’s break down the “how.”

Key Components of Data Engineering

Building Data Engineering solutions isn’t just about dumping everything into a cloud server and hoping for the best. It requires a solid foundation:

- Data Ingestion – Start with this first step: collect data from multiple sources such as APIs, databases, IoT devices, and social media.

- Data Storage – Your business will need a reliable home for your data – be it a traditional data warehouse (structured) or a data lake (unstructured).

- Data Processing – This is the stage where your raw data is cleaned, altered, and organized. Consider ETL (Extract, Transform, Load) pipelines that set up data for analysis.

- Data Orchestration – Automation solutions ensure the data processes operate smoothly while minimizing human errors.

- Data Governance & Security – GDPR and CCPA require uptight data security.

- Real-Time Analytics—Companies must stream data processing to make decisions quickly and on the go.

Data Engineering vs. Data Science: What’s the Difference?

They may seem very similar, but they are very different. Let’s simplify this for you. Data Science is like being a detective. One that digs into data to uncover patterns, trends, and insights. On the other hand, data engineering is like setting up a world-class crime lab that assists the detective in getting to the right clues. So, while one finds relevant data, the other makes sure the data is easily available and usable.

Without Data Engineering, data scientists lose almost 80% of their time because they have to clean and organize data instead of actually analyzing it. However, they can focus on extracting value and driving business impact with it.

Top Tools & Technologies in Data Engineering Solutions

The tech stack for Data Engineering solutions is constantly evolving, but here are the must-haves:

Data Storage & Management

- Amazon Redshift / Google BigQuery – Scalable cloud data warehouses.

- Apache Hadoop / Apache Spark – For massive distributed data processing.

- Snowflake – A high-performance, cloud-native data platform.

ETL & Data Pipeline Tools

- Apache Airflow – Automates and manages workflows.

- AWS Glue / DBT (Data Build Tool) – Streamlines ETL processes.

- Talend / Informatica – No-code ETL platforms for enterprises.

Streaming & Real-Time Processing

- Apache Kafka – Handles real-time data streaming like a pro.

- Google Dataflow – Processes real-time and batch data seamlessly.

- Flink – High-performance, scalable data streaming.

Data Governance & Security

- Apache Ranger – Manages security policies across data lakes.

- Collibra – Enterprise data governance at scale.

- Okta – Identity management and access control.

The Future of Data Engineering

The world of Data Engineering is only getting bigger. Here’s what’s next:

- AI-powered automation – ML-driven pipelines that self-optimize.

- Serverless data engineering – No infrastructure management, just pure efficiency.

- Data Mesh – Decentralized data ownership for more agile businesses.

- Edge Data Processing – Processing data closer to the source (IoT, mobile devices, etc.).

Real-World Examples of Data Engineering in Action

To demonstrate the impactful capabilities of Data Engineering, take a look at these success stories from Fingent’s collection:

-

Improved Decision-Making in Retail

Premium Retail Services (PRS) managed field marketing services for Samsung’s US market. Their representatives collect over a million data points monthly from over 12 retail segments. However, their reporting systems were outdated, and relying on PowerPoint and Excel led to delays and inefficiencies.

Solution: Fingent took the bull by the horns, so to speak, by developing a customized data analytics and visualization platform.

Result: This solution transformed complex datasets into intuitive visuals. It also automated data input and streamlined field data management. This enhanced their performance reviews and improved decision-making.

-

More Reliable Financial Forecasts

Quantlogic, a research firm, processed over 200,000 data touchpoints across 12 verticals in real-time in the financial sector. Its goal was to refine predictive algorithms for better investment planning.

Solution: Fingent implemented an advanced predictive analytics platform.

Result: This platform improved data quality and predictive accuracy. Thus, enabling Quantlogic to make more reliable financial forecasts.

-

Data Analytics to Determine Hospital Performance

The National Health Service (NHS) England struggled to evaluate hospital performance. This was due to their incongruent data sources and complex metrics.

Solution: Fingent deployed a comprehensive data visualization solution. This solution offered interactive graphs that linked across multiple disciplines. This system provided detailed analyses of key performance indicators.

Result: Now, NHS England can make informed decisions to enhance patient care and enjoy operational efficiency.

AI Tools for Data Analysis: Your Co-Captain to Business Success

A Look into The Future of Data Engineering

The field of Data Engineering is swiftly evolving. Here’s what businesses can anticipate:

- AI-Powered Automation: This will eliminate the need to monitor data pipelines manually. Machine learning algorithms will automate data pipelines and self-optimize whenever necessary.

- Serverless Data Engineering: When you shift towards serverless architectures, your business will be able to focus on data processing instead of battling to be the tech support. The benefit? Grater scalability and cost efficiency!

- Data Mesh Architecture: This approach enables you to own data. Each of your departments would be like a mini startup—independent, flexible, and accountable.

- Edge Data Processing: With this, you can process data right where it began. IoT devices and mobile applications will see reduced latency while enabling real-time analytics.

How Fingent Can Help

We understand that navigating the complexities of Data Engineering is not as easy as it seems. Yes, it requires expertise and a forward-thinking approach. At Fingent, our experts specialize in crafting tailored Data Engineering solutions. And we ensure the solutions we provide always align with your business objectives. Let’s take us through our services:

- Custom Software Development: We will build scalable and robust applications that meet your specific data needs.

- Digital Transformation Consulting: We will be there to guide your journey to data-centric architectures.

- Cloud Strategy Consulting: We are equipped to design and implement flexible and scalable cloud-based data solutions.

Contact us today to discuss Data Engineering solutions.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Businesses need modern technology to survive today’s ever-evolving market. The right enterprise software solution can help businesses thrive. However, not all businesses might have the necessary in-house skills to develop one, and let’s be honest, off-the-shelf software does not fit all needs. Thanks to custom software development vendors, enterprises can access technology experts on the go to build customized technology solutions that cater to their unique business needs.

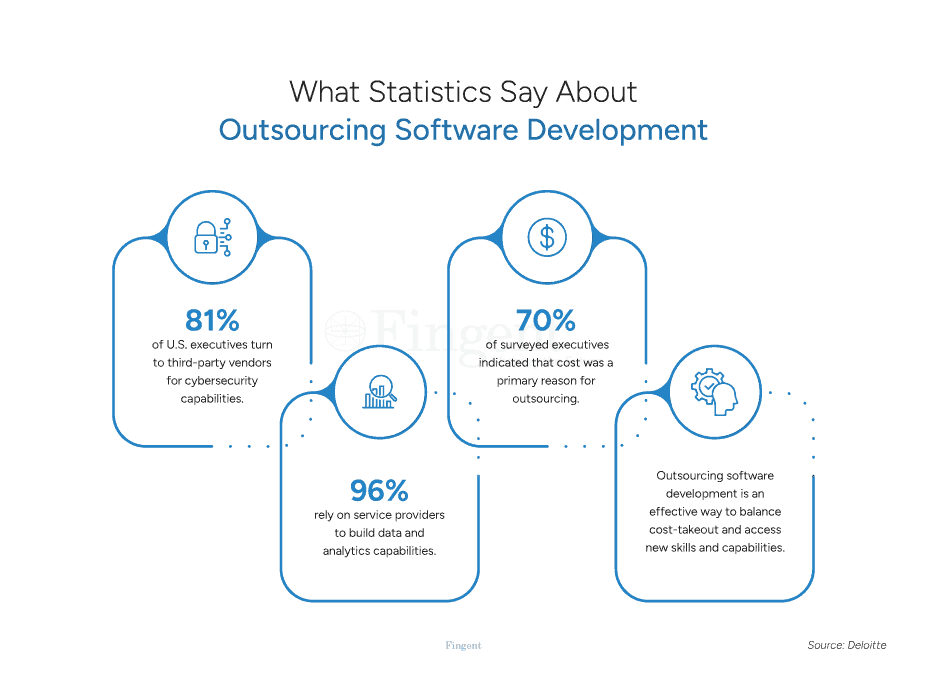

According to a survey by Deloitte, 79% of U.S. executives currently outsource software development. However, any business application is only as good as the developer who creates it. Choosing the right software development partner is a crucial responsibility.

If your business plans to hire an app development partner, here’s a quick checklist that can help. But before we get started, let’s look at why you need to choose the best software development vendor.

Have an Innovative Idea for Your Next Application?

Why Do Businesses Need Software Development Vendors?

Organizations rely on app development partners to:

- Bridge talent gaps and save in-house hiring costs

- Drive value by developing end-to-end solutions

- Access the best of technology, skills, and expertise

- Avoid development delays and cut operating costs

- Increase speed-to-market and enhance core competencies

- Mitigate the risks of running an in-house development project

You can easily unlock these advantages by choosing the right software development vendor. But what happens if you choose the wrong app development partner? Here are the risks!

Risks of Choosing a Wrong Software Development Vendor

Wrong software vendor selection can leave a lasting impact on your company.

- Poor-quality software rollouts can lead to massive sales losses. It can force your customers to go to competitors.

- Ill-fitted software solutions affect your day-to-day operations and increase your team’s workload.

- A bad match will never help you with add-ons and customizations you might need for the future.

- Botched software can cause frequent business disruptions. It can affect your customer experience, reputation, and brand.

- Faulty software can lower your team’s morale and engagement. Constant software glitches add to employee frustration and fatigue.

- A wrong vendor may not be able to meet your deadlines. They may also charge you more than expected. There is always an inherent risk of hidden costs.

- Communication breakdowns can create misunderstandings between the vendor and your stakeholders.

- Inadequate security measures opted by the vendor can put your business at risk. It can increase the chance of damaged, lost, or stolen data.

How can you avoid these risks? Ace software development vendor selection by using our checklist (below).

Why is Legacy Software Modernization Inevitable for Businesses?

Checklist: How to Choose the Right Software Development Vendor?

1. Define Your Needs and Goals

The first step to finding the right developer is identifying your goals. Why do companies seek to build customized software? Some of the common reasons are:

- Enhancing customer experience and satisfaction

- Improving workforce productivity and operational competency

- Tracking and managing staff responsibilities

- Automating specific tasks and repetitive functions

- Boosting reliability and security

A good discernment of your objectives and business needs will allow you to proceed to the next steps more efficiently.

2. Set up a Budget

Defining your goals should help you prepare a detailed budget. At this stage, it is important to determine the capital, expenditures, and forecasted return on investment (ROI).

Assess the factors that impact the cost of your software development project:

- Type of software you need and its level of complexity

- Custom software or off-the-shelf software

- UX/UI design considerations

- Backend infrastructure and dependencies

- Integrations with other applications you use

- Location of the app development partner

- Development time, resources employed

- Investments in new technologies

- Estimates/rates quoted by the software development vendor

Any business’s priority is to produce high-quality software. However, keeping the project within budget is vital for business success.

3. Research Potential Vendors

Research potential software development vendors. Assess the selected app development partners based on the following factors:

- Do they have experience working on the type of software you need?

- Have they worked in your industry or domain in the past?

- Do they handle the entire software development lifecycle? Do they provide post-launch application maintenance and support?

- Do they help train your staff on the new software?

- What are the services they offer?

- Does their rate fit your budget?

- What other value-added services do they provide software development? Developing an e-commerce application, maybe?

4. Shortlist Top Software Development Vendors

Choosing from hundreds of service providers can be overwhelming. Once you do the research and specify your requirements, you can start shortlisting the options you find appealing.

Here are a few ways to narrow down your list:

- Read through the company profiles, case studies, and client testimonials of potential vendors.

- Use any credible B2B rating platform to check out their ratings and reviews. Platforms like Clutch, GoodFirms, etc. list the top vetted software development partners.

- Filter vendors based on their minimum project costs, team size, average ratings, and location.

- Keep your list short so you can reach out to the selected firms quickly.

5. Talk to Each of the Selected Vendors

A direct conversation with the software development vendor gives you a fair idea of their services and expertise.

Before meeting a vendor, prepare a set of questions that will help you gauge their work:

- What technologies and programming languages are your team proficient in?

- What are the industries and domains that you primarily cater to?

- What project management tools do you use to manage your workflows?

- How do you ensure the quality of your software?

- What is your project engagement model?

- What software development methodology do you follow—Agile, Waterfall, RAD, Lean?

- How do you determine the costs of your work?

- Is my budget and expected timeline realistic for my project?

Above all, it’s crucial to identify if the potential vendor’s way of operating and objectives align with your requirements.

6. Narrow Down Your List Further

A direct conversation with each vendor should help you narrow your choices between two or three developers.

- Consult your leadership team. Weigh the pros and cons of each vendor based on your analysis.

- Shortlist your selection to one or two providers. Ensure they can understand your needs and match your company’s culture.

7. Data Security and Privacy Measures

Your business software needs to handle confidential company data. Is your software development partner capable of protecting your application from cyber threats?

- Before choosing a software development vendor, undertake an intellectual property due diligence inquiry.

- Find out how the vendor will be handling your data and assets.

- Review their integrated security and IP protection program.

- Determine the internal measures you should adopt to safeguard your enterprise’s IP.

- Identify which functions need to be managed in-house and what should be outsourced.

8. Compliance, Reliability, and Support

Along with analyzing the vendor’s cybersecurity offerings, you also need to verify:

- Does the vendor’s development and delivery practice/policies comply with the essential regulations?

- Have you done extensive background checks to ensure the integrity and reliability of the vendor?

- Did you do a proper technical and strategic vetting of the selected development vendor?

- Is the vendor equipped to address unexpected IT outages and disruptions?

- What are the risk management policies/processes followed by the software development vendor? Do they have a robust disaster recovery plan?

- Does their development process align with your organization’s sustainability goals?

- Does the vendor stick to responsible application design, development, and maintenance that can reduce the environmental impact?

Choosing the right software development partner requires careful planning. It’s indeed a very tricky job to pick out the right one from a huge list of potential vendors. The checklist aims to make the job simple for you.

Nearshore vs In-House Software Development: Know The Pros & Cons

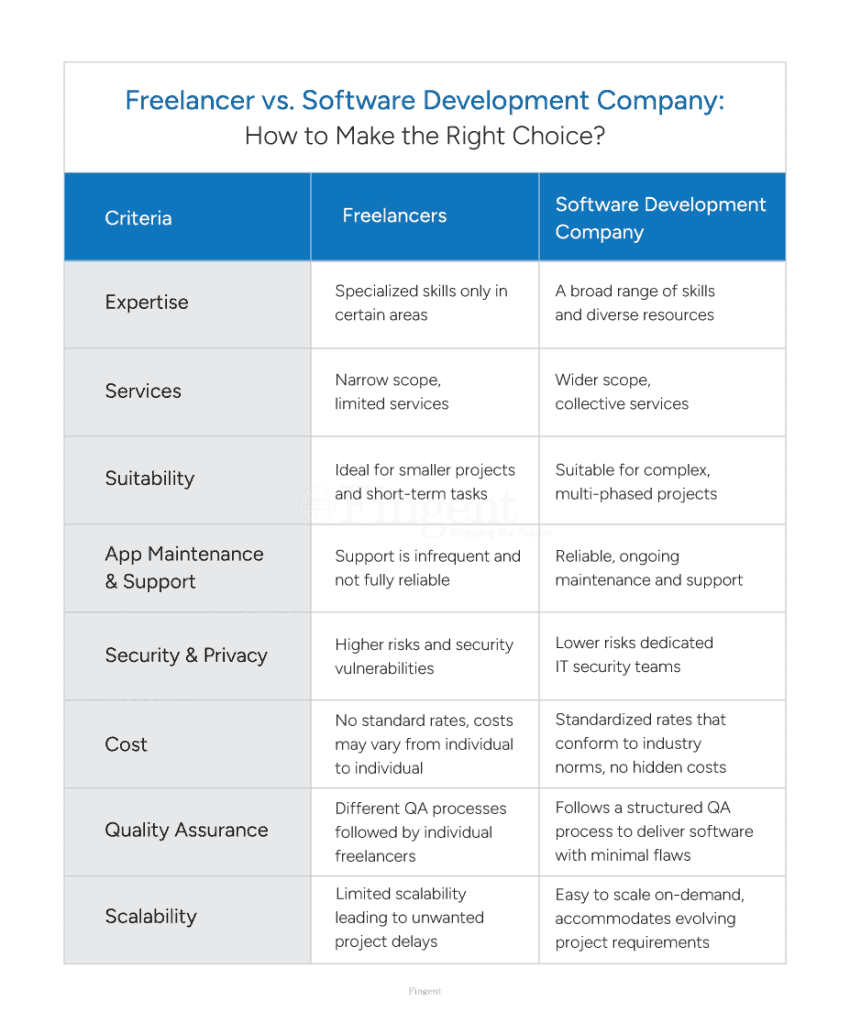

Software Development Company vs. Freelancer: Which is Better?

What is the difference between a freelancer and a software development company?

- A freelancer is an individual who works independently on software development projects.

- A software development company is a professional organization that provides software development services.

How does working with a software development company help your business?

- A team of certified professionals well-versed in multiple areas

- Access to the latest technologies and specific domain expertise

- A reliable vendor-customer contract (agreement) to back you

- Round-the-clock support and IT help desk

- Transparent communications, no hidden surprises

- Standardized pricing with no additional costs

- Dedicated ongoing maintenance and support

Transform Your Business With the Right Software Development Vendor

The best software development vendor:

- Works with you throughout the entire development process

- Helps navigate the complexities of software creation and maintenance

- Makes incremental changes for continuous software enhancement

- Develops tailor-made solutions that align with your business goals

- Improves your business’s efficiency, productivity, and financial performance

Let Us Help You Ease Your Digital Transformation Journey

Why Choose Fingent as Your Software Development Partner?

Since 2003, Fingent has been a reliable and capable software development partner for leading global brands, including several Fortune 500 companies.

- An impeccable track record as a successful custom software vendor

- Experience in new and emerging technologies—AI, AR, VR, IoT, blockchain, and more

- Legacy application modernization, cloud migration

- Multi-platform development—web, mobile, cloud, and more

- Diverse offshore talent pool with experienced developers and tech professionals

- Tech certifications, partnerships, centers of excellence

Build scalable and robust applications by partnering with a professional custom software vendor. Contact us to get an extended consultation.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

AI in Business is a present reality! It’s a building revolution that is all-encompassing and is redefining business operations. You have only two options. Either ride on the crest of this wave or get submerged if not prepared!

How can you become AI-ready? In this blog, we aim to clarify pertinent questions a business leader may have to achieve this goal successfully.

Why Do Business Leaders See AI as a Game-Changer?

A survey of around 2,000 executives, CFOs, and CEOs across 9 countries showed that “61 percent believe AI is a game changer for their industry, with the figure rising to 82 percent in the tech sector and 51 percent among automakers.”

They have a good reason for this, too. AI can bring phenomenal improvements in virtually every sphere of business. Automating tasks, improving forecasting, supporting intelligent decision-making, tightening compliance and security – AI does all this and more.

The future of business is intelligence. And those who prepare for the AI revolution today will lead the way tomorrow. Preparing for an AI revolution is much like training for a championship team. Even the best players can’t win without rigorous training, good planning, and top-tier equipment. Likewise, to stay ahead in the competitive market businesses need AI preparation. This will help you to harness cutting-edge tools, refine your strategies, and build a skilled team.

This could result in more intelligent business tactics and improved customer interactions. As leaders, you are undoubtedly enthusiastic about the potential cost savings. More importantly, consider how it can offer personalized services on a grander scale.

Don’t Stay Behind! Unlock Business Growth, Efficiency & Innovation With AI.

How Do I Know If My Company Is Ready for AI Adoption?

Adopting AI in business is transformative. It entails careful consideration and strategic planning. Here are some critical questions to help you assess your company’s readiness for AI adoption:

1. Is There a Genuine Need for Your Business to Have an AI Solution?

Arrange for a thorough analysis of your business processes. Does your business depend on large amounts of data? Are there many tasks that can be automated? Have there been security leaks or a risk of losing valuable business if there were? This analysis will help pinpoint areas where AI can provide tangible benefits and solve existing challenges.

2. Where Can Automation Take the Load Off?

AI’s most impactful applications include automation. Identify regular, repetitive activities in your company. Automating such tasks can enhance effectiveness and minimize the risk of human mistakes. This will enable your team to focus on innovation and more valued activities.

3. Are Your Employees and Stakeholders Ready to Adopt AI?

Successful AI implementation requires teamwork among your employees and stakeholders. Conduct a survey to assess the team’s willingness to adopt AI. Then, guide and support your team in understanding AI’s capabilities through training and resources. Engage stakeholders right from the planning phase. This action will guarantee that concerns are addressed and that you have their backing.

4. Do Your Customers Understand How You Use AI?

Ensure that your customers understand how AI is being used to enhance their experience. Help them experience the benefits. Building trust through transparency will foster customer acceptance of AI-driven innovations. Also, provides customers with options to interact with human representatives. This will help maintain a balance between automation and the personal touch.

5. Do You Have AI Expertise, Experience, and Talent?

Successfully integrating AI is not simple. It takes a combination of knowledge, skill, and expertise. Check if you have it. If you spot any deficiencies in AI knowledge and skills, think about hiring AI experts or teaming up with outside specialists. Create a strong AI team.

How to Prepare Your Company for AI Adoption?

Preparing your company for an AI in business strategy is crucial if you want it to succeed. Done right, it can bring unprecedented efficiencies and competitive advantages. If done wrong, the risks could cost you quite a pretty penny. So before you dive in headfirst, let’s talk about those annoying risks.

1. Analyze the Risks

- Ethical and Legal Risks: If you don’t want AI to cause unnecessary stress, follow ethical guidelines and legal standards. Identify and remove biases from your AI models.

- Security Risks: Cyber-attackers love AI systems. Analyze and beef up your cybersecurity to protect your precious data.

- Operational Risks: What can you do when you face workflow disruption? Plan ahead! Planning well in advance to address disruptions can keep things running smoothly.

- Financial Risks: True, AI isn’t cheap. Apportion funds to cover all those costs and then some.

- Workforce Impact: AI can change the nature of jobs. Prepare your workforce for these changes. Reskill, upskill, and repeat.

2. Calculate the Pros and Cons

As with everything, there are pros and cons to the application of AI in business. It’s better to be conversant with all its strengths and weaknesses. Here is how you can understand AI’s value versus potential drawbacks.

Pros:

- Increased Efficiency: Like a robot butler, AI applications in business take care of all the boring, repetitive tasks, allowing your employees to focus on strategic activities.

- Improved Decision-Making: Like a wise old sage, AI’s data analysis can dispense deeper insights for better decisions.

- Cost Savings: AI cuts operational costs and hikes profitability.

- Enhanced Customer Experience: AI in business personalizes interactions and turns customer service into a 5-star experience.

- Innovation Opportunities: AI innovation leads to a goldmine of new product ideas and market strategies.

Cons:

- Initial Investment: AI implementation can be costly at the beginning.

- Integration Challenges: Integrating AI with IT infrastructure can be complex and time-consuming.

- Skills Gap: If your organization lacks AI expertise, you will have to invest in training or hiring new talent.

- Dependence on Data Quality: AI relies on high-quality data. What goes in is what comes out. Poor data leads to inaccurate results.

- Ethical Concerns: AI raises ethical questions. Data privacy and bias in decision-making are the two main concerns.

3. Centralize Your Company Data

Data is the source of energy for AI systems. Effectively adopting AI depends on centralizing, organizing, and ensuring data accessibility. Here are some ways you can achieve that:

- Data Integration: Merge data from different sources into a centralized platform to ensure detailed AI analysis.

- Data Quality Management: Establish governance practices to guarantee data accuracy, completeness, and consistency. Also, regularly clean and update data.

- Data Security: This could include encryption, access controls, and regular audits.

- Scalable Data Infrastructure: If your data infrastructure is unable to handle large volumes, consider investing in cloud storage.

- Data Accessibility: Do your stakeholders have the required access to data? If not, implement user-friendly tools. This will facilitate easy data access and analysis.

4. Prepare a Roadmap for Future Scalability

A strategic roadmap is necessary for leading AI adoption and ensuring future scalability.

- Define Clear Objectives: Set distinct goals for AI initiatives. Then, align them with business strategy and address specific pain points.

- Pilot Projects: Start with small pilot projects to test AI feasibility and impact. Collect insights, fine-tune your approaches, and build confidence.

- Continuous Improvement: Regularly evaluate and enhance AI strategies and solutions. You can do this by using performance data and feedback.

- Stakeholder Engagement: Engage key stakeholders throughout the AI adoption process. Inform them about progress, challenges, and successes to ensure support.

- Resource Allocation: Ensure necessary resources. Budget for ongoing costs like maintenance, training, and upgrades.

- Training and Development: Invest in training programs to build AI expertise. Encourage continuous learning to stay updated with AI trends and technologies.

A Leader’s Blueprint For AI Success

How Can Fingent Help Me Streamline AI Adoption?

The application of AI in business is transformative but complex. At Fingent, we streamline this process seamlessly. We develop tailored AI strategies aligned with your business goals, conduct a thorough risk assessment and mitigation for ethical, legal, operational, financial, and cybersecurity risks, and ensure centralized data management and integration with scalable cloud solutions. Our custom artificial intelligence (AI) solutions integrate smoothly into your IT infrastructure, starting with pilot projects for validation.

Contact Fingent now to start your AI expedition!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Business Intelligence in Financial Services is proving to be a game changer.

Business intelligence is a novel technology backed by AI. It is a combination of strategies and processes. Simply put, BI collects, cleans, formats, and analyzes data.

No big deal? Think again!

In a world that is ruled by data, this is a superpower.

Business intelligence is, in fact, a CFO’s best friend. It enables users to perform a wide range of activities with great ease. Since their advent, BI solutions have played a key role in banking and finance services. Business Intelligence in Financial Services offers priceless tools for risk assessment and cost management plans. They also provide detailed customer insights – a 360-degree view of the customer, which is priceless. So, in our current era, where data is everything, BI has become a valuable asset that offers support in decision-making.

Let’s discuss this in detail. First, let’s talk about the elusive 360.

Elevate Your Customer’s Digital Banking Experiences

The Need for a 360-View of Customers and Buyers in the Store

This technology is growing in popularity. It has become a well-favored tool among companies worldwide. A recent report predicts growth in the global business market. The predicted price for business intelligence and analytics software applications is $18 billion by 2026.

The concept of a 360-degree view is vital for businesses to function while predicting customer needs. This paves the path for meaningful insights and allows for more personalized interaction. The benefits of this method are listed below.

1. Superior Customer Understanding: The 360-degree view allows business owners to predict customers’ needs, allowing for more personalized interactions and rapport-building.

2. Personalized Marketing: Businesses can understand the customer’s preferences through the customer journey map. This map enables businesses to unravel customers’ thinking and curate marketing strategies, ensuring higher engagement and conversion rates.

3. Improved Customer Service: A 360-view means that the service representatives can access a customer’s entire history. Based on the client’s past behavior patterns, this method provides customizations. This personalization is evident in their interactions with you. In turn, it boosts customer satisfaction.

4. Operational Efficiency: With 360-degree view data collection, businesses can streamline their processes, making operations smoother and more efficient. The 360-degree customer view is a method that has revolutionized customer-service provider interactions. These conversations give clients a unified view of the customer’s journey. They also enable collaboration between different departments.

Why Do You Need a BI Strategy for Your Financial Business?

Technology is rapidly growing, and the amount of data generated in today’s business world is enormous. We create around 2.5 quintillion bytes of data every day!

Legacy financial processes have started failing. They don’t have the right tools to handle this much data. An efficient business intelligence strategy would be your knight in shining armor. It enables you to measure and evaluate performance. You can also identify competitive advantages and make informed, data-driven decisions. Other reasons why you should install this technology into your financial services include:

1. Better Decision Making

Business Intelligence implements Predictive Analysis to enrich the decision-making process. This derivative of AI can learn encoded data, recognize recurring patterns, and make accurate predictions. This greater visibility into potential outcomes based on past performances is the best tool for a business. Companies with an efficient BI strategy can gain insights on their customer behavior. This arms them with the ability to anticipate trends in the market and adjust business operations accordingly. Subsequently, the company’s risk of losses due to market shifts also drops.

Additionally, Business Intelligence improves communication between departments within the company. Employees can share meaningful insights from various datasets, removing the need to rely on anecdotal evidence. Working together towards a shared goal will boost efficiency and increase profits.

2. Increased Operational Efficiency

With a strong BI strategy, companies can streamline internal processes. They can also analyze employee behavior and performance to uncover hidden talent. Data analytics, a subset of BI, can shed light on how to optimize efficiencies within the organization. Companies with BI systems generally switch from manual, time-consuming labor to automated systems, which makes them more agile and frees up resources.

3. Solid Risk Management

Predictive Analytics and Machine Learning are potent tools for a business owner. These systems can also assess risks while predicting future trends. With these risk insights, companies can avoid making certain investments and commitments. This will help companies reduce losses that could hurt their bottom line if left unchecked.

4. Boosts Customer Retention

Financial business intelligence equips you with the most current information on customers. Banking and finance institutions can keep their marketing and sales teams armed. With BI’s help, your teams can recognize the organization’s most loyal and profitable clients. This information is gold as teams can concentrate their efforts on retaining these customers. They can also gain insight into the kind of customer that they can attract to their business,

5. Offers Competitive Edge

Due to its long list of perks, the BI strategy has the power to give you a strong competitive edge in the market. It also helps you streamline the best BI solution vendor for your financial business. These services are also integrated with superior features.

6. Reducing Costs

Cost-effectiveness is a quality check for the business intelligence strategy you use. Using predictive analytics and other BI tools, budgeting becomes more precise. Resource allocation is thus streamlined, and opportunities for cost reduction are identified; an efficient BI strategy will oversee training offerings and associated costs as well. This will help you budget and reduce unforeseen spending.

How Is AI Transforming Financial Services: Use Case and Applications

How Can You Build a Successful BI Strategy for Your Financial Services Business?

A solid BI strategy can improve customer retention, optimize costs, and provide competitive advantages. It is vital for your plans and business goals to align with your Business Intelligence strategy to make it a success. Here are the key steps involved in building an efficient BI strategy:

1. Assess and Define Your BI Ecosystem

Gather all the information you need before embarking on this journey. A sound data plan is vital for your implementation. It should include identifying data sources and visualizing a strategy. Gather relevance from your data sources (clients, projects, sales, marketing, finance, etc.) You can organize them by department, function, or business impact to streamline the process. Visualizing a strategy will encompass discussing the company’s vision with stakeholders. Create an alluring presentation for them with the help of a designer. In your presentation, be sure to highlight the reasons and benefits of a BI strategy.

2. Budgeting

Your immediate next step is to develop an accurate budget. Without planning, the BI strategy implementation process can be expensive and can cause financial strain for the company. Developing a strategy beforehand will prepare you for any unforeseen expenditure.

3. Assemble Your BI Team

Select a group of proficient employees to work as your BI implementation team. Include company stakeholders in the team to keep them in the loop. Your team should include an HR employee, a scheduling officer, one from the union, and a legal assistant. This will be your army, as it were, so ensure you make the right choices.

4. Choose Your BI Platform

Your business goals are bound to change. Aim to install BI software that provides self-service templates and easy usability for beginners. This step is very important because it will define how your company is affected during and after implementation. Take your time, explore various platforms, and carefully make your pick.

5. Select Your BI Software Partner

This is a delicate journey. Be bold and decisive when you reach this step. Remember that the partner you choose will guide you throughout. Compare different partners to rate their different features. Lastly, combine this with previous reports and review them. Conducting demos is the most effective method for this step.

6. Plan User Training

Imagine if, after all the effort put into implementation, no employee is equipped to handle the aftermath. A true disaster! This is why planning early user training is so important. Once you have decided on a service provider, it’s time to plan your training program. Sometimes, service providers provide video training and live classes. This helps users set up and get familiar with the software. Training will help employees stay updated on insights and learn the best features.

7. Refine Your Data

This is the last stage of preparation to build a successful BI strategy. Refine your data structures and remove waste. The cleanest data possible will yield the best productivity results. The quality of data you enter into Power BI will affect the quality of insights you get, so it’s crucial not to underestimate this step.

How Does Business Intelligence Benefit Financial Services?

A solid BI strategy can improve customer retention, optimize costs, and provide competitive advantages. Here are some top benefits of implementing BI into your financial service strategy:

- Real-time insights: Financial BI can spontaneously access any financial data recorded, allowing for quicker and more informed decision-making.

- Improved reporting: Writing reports is a tedious job that can be automated with financial BI. This frees up employees to take part in analysis and interpretation.

- Cost savings and revenue growth: Financial BI can help businesses recognize areas of incompetence, cut costs, and discover new revenue streams.

- Increased efficiency: Financial BI can automate and streamline financial processes, reducing manual work and avoiding the risk of human error.

- Transparency and collaboration: With financial BI, communication between other departments and finance is reinforced.

How Can Fingent Help in Bringing Business Intelligence to Your Financial Service?

Fingent is known for using cutting-edge technology to ensure the best outcomes for clients. These technologies include machine learning, natural language processing, and more. These can be fashioned into valuable Business Intelligence tools customized for your business.

We can help your financial organization stay ahead of the competition. The software designed for you will ensure that your organization remains resilient regardless of any form of disruptive circumstance. Experts at Fingent empower businesses to maintain momentum with new developments. They also measure the effect of changes on customer requirements. Our custom software development experts at Fingent can help you understand everything you need to know about business intelligence.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Artificial Intelligence is a multi-talented assistant and has proven its worth in the healthcare industry. Healthcare organizations have found innumerable ways to use AI, from record maintenance to patient assistance. It has completely reshaped how doctors diagnose, treat, and monitor their patients. It is also capable of drastically improving research methods, which leads to unmatched accuracy in diagnoses. By integrating AI into hospital settings and clinics, healthcare systems can potentially become smarter, faster, and more efficient worldwide. This blog will help you explore the immense possibilities of AI in healthcare!

How is AI Used in Healthcare?

Healthcare AI, valued at $11 billion in 2021, is expected to be worth $187 billion in 2030.

This massive increase will mean that we will continue to see exponential growth in how medical providers and organizations in the healthcare industry operate. So, how are they using this power tool? Here are some ways.

1. Easing Administrative Workflow

Artificial Intelligence can process and analyze extensive amounts of clinical documentation within a few minutes. This enables professionals to spot disease markers and trends that could be overlooked with manual analysis. AI can automate mundane tasks such as data entry, claim processing, and appointment scheduling, freeing up time to focus more on patient care and the management cycle. Artificial intelligence also eradicates the risk of human error by offering a faster way to analyze and review health records, medical imaging, and test results.

2. Disease Detection

Machine learning (ML) is an area of AI that reads patterns and allows a machine to learn and apply the learned experience to similar scenarios. It enables physicians, researchers, and patients to identify impending diseases. Researchers and practitioners claim that machine-learning-based disease diagnosis is inexpensive and time-efficient. Furthermore, a current study proves that these diagnoses have an accuracy rate of 90%. Diseases like dementia, heart failure, breast cancer, and pneumonia can be identified with ML. The emergence of this fascinating technology in the diagnosis domain illustrates the utility of AI in medical fields.

3. Automate Documentation, Store, and Organize Health Data

Documentation and organization processes are monotonous. They can be very tiresome and boring, leading to human errors. This process can be automated by Natural Language Processing (NLP), which interprets and uses human language to perform tasks. NLP can improve patient care with accurate diagnosis, streamlined clinical procedures, and customized services. It can also help analyze medical records and suggest improved treatment methods. The most common use of NLP in healthcare is to analyze and classify medical records.

4. Accelerate Drug Discovery and Development

AI assistance to the pharmaceutical industry can improve the overall life cycle of products and make great leaps in medical research. It can be integrated into various tasks, such as drug discovery, drug repurposing, clinical trials, and product management. This reduces the workload on human employees while simultaneously achieving targets in a short period of time. Artificial intelligence can identify hit-and-lead compounds in drug research. This allows it to provide quicker verification of the drug target and optimize the overall drug structure.

5. Medical Inventory Auditing

Inventory management is a strenuous task that requires close attention and constant supervision. However, when you integrate AI into inventory management, you can curate a seamless flow of products.

Computer vision can help in this regard. It is a type of AI that can analyze images and perform tasks that replicate human behavior. With computer vision, medical institutions can automate their auditing process and reduce errors in shipments of surgical supplies.

Artificial intelligence can also assist medical organizations with product evaluation, prioritizing inventory tasks, and allocating inventory information across the organization network. AI in the medical industry can also automate small tasks such as the transcription of bills and the recommendation of products based on a surgeon’s order history. Even this simple automation can bring overall accuracy to the functioning of inventory.

Virtual Reality is Reshaping the Future of Medical Device Training

6. Virtual Nursing Assistants

A virtual assistant is a manifestation of AI that provides 24/7 support and monitoring for patients. It consists of AI-driven chatbots that further enhance patient engagement and adherence to treatment schedules. The overall market for virtual healthcare assistants is growing at a CAFR of 30% from 2023 to 2033. This says it all!

Surgical robots are another brilliant invention powered by artificial intelligence. They can perform minor surgeries with a high level of proficiency. These robots can also collect patients’ previous medical records and make appropriate suggestions to surgeons. Medical researchers and scientists are now striving to create an AI robot fully capable of performing complex surgeries.

7. Personalized Fitness Coach

We have all encountered health and fitness monitors, such as smartwatches and apps that can track and analyze our medical histories. These monitors are also powered by artificial intelligence. They store real-time data sets, and they will alert the user when they recognize a suspicious pattern.

AI can also transform limited customer service into a highly scalable, personal service that provides multifaceted recommendations through real-time conversational AI. On a larger scale, AI solutions, such as data applications, ML algorithms, and deep learning algorithms, can also help healthcare professionals. They can analyze large amounts of data and offer suggestions before professionals make decisions.

8. Patient Prioritization System

According to a recent study, 83% of patients report poor communication as the worst part of their experience in healthcare centers. This illustrates the desperate need for a clearer form of communication between patients and healthcare service providers. AI technologies like natural language processing, predictive analytics, and speech recognition can monumentally bridge this gap.

Clinical AI is also created to focus specifically on patient care. It uses various subtypes of AI to improve patient treatment. Predictive analytics is another helpful area of AI. It predicts potential health complications by analyzing patterns in a patient’s medical history and current health data. Since this AI takes a proactive approach, it ultimately leads to better patient outcomes and reduced healthcare expenditures.

9. Less-invasive Surgeries

AI-enabled applications can assist in the development of advanced guidance and navigation systems. They improve the accuracy and precision of surgical procedures. AI-enabled applications can also be used to work around sensitive organs and tissues. They can help reduce blood loss, infection risk, and post-surgery pain. AI-powered image analysis tools can also be used to spot surgical instruments and structures within the body. It can analyze past surgeries, allowing the surgeon to be well-prepared beforehand. This creates a more personalized approach to surgical planning and execution.

A Quick Guide to Custom Healthcare Software Development

What are the Top Benefits of Using AI in Healthcare?

The benefits of AI in healthcare are manifold. However, its application has reaped the most benefits in fraud prevention, healthcare diagnosis, and preventive care. Here are more details:

1. Fraud Prevention

Integrating AI can help recognize suspicious patterns in insurance claims. Sometimes, people will bill for costly services or procedures that are not performed, or they will undertake unnecessary tests that take advantage of insurance payments. Another famous type of false claim is unbundling. This is when people provide billing for individual steps of a procedure rather than the procedure as a whole. These scams can be detected by predictive analytics.

2. Increased Efficiency in Healthcare Diagnoses

A study in Harvard’s School of Public Health stated that using AI to derive diagnoses may reduce treatment costs by up to 50% and simultaneously improve health outcomes by 40%. Other studies suggest that deep learning AI technology can accurately predict breast and skin cancer, even better than experienced doctors.

3. Better Health Monitoring and Preventive Care

AI can help providers gather information from multiple wearables and monitoring devices. It can then be stored and analyzed to provide data-driven insights from many people. With AI-integrated health monitors, patients and caregivers can communicate better. These monitors can be wearables, sensors, or telehealth. They are used essentially by patients to identify symptoms early on and provide timely changes. They come in two distinct forms: AI chatbots, virtual assistants, and ambient/intelligent care.

What are the Types of AI Used in Healthcare?

Many forms of AI have been successfully implemented in the healthcare industry. Some of these are listed below:

1. Machine Learning

Machine learning algorithms can identify patterns and form predictions by processing clinical data. This form of AI helps analyze patient records, discover new therapies, and perform medical imaging. Hence, it makes life easier for healthcare professionals and reduces costs for the patient. ML can precisely diagnose diseases, personalize treatments, and identify any changes in vital signs.

2. Deep Learning

Deep learning is a subset of AI used for tasks like speech recognition through natural language processing. This representation-based learning method is obtained by composing simple and nonlinear molecules from a lower level into a representation at a higher, more abstract level. Deep learning models are generally integrated with computer vision, speech recognition, and natural language processing to get the best results.

3. Natural Language Processing

Natural language processing (NLP) enhances patient care by improving diagnosis accuracy, streamlining clinical processes, and providing customized services. NLP can accurately diagnose illnesses by extracting important data from medical records. It can also determine the appropriate treatments and medications for each patient. This form of AI has become a powerful weapon in the modern healthcare industry.

4. Generative AI

Generative AI is a part of machine learning technology. It is trained with old data, and when commanded, it provides new data similar to the legacy data. It is used primarily for image and speech synthesis. Generative AI has untapped potential. It has the power to automate entire systems, enhance clinical decision-making processes, and even administrative processes. Generative AI shows great potential despite being scarcely implemented.

Explore What AI Can Do For Your Organization

What is the Future of AI in Healthcare?

AI in the healthcare market was worth over 11 billion U.S. dollars in 2021. The next prediction is that this market will outdo itself and reach around 188 billion U.S. dollars by 2030. This elucidates the drastic impact that AI has on the healthcare industry.

Artificial intelligence offers us many opportunities to help reduce human error and assist medical professionals. It holds heavy promises of enhancing patient experience, tightening safety, and reducing costs associated with healthcare services. As these tools and technologies continue to develop, the potential to use AI will exponentially boom.

Future AI tools will have the ability to automate or augment the workload and further free up humans to spend more time on other important tasks. Deep learning AI may progress to detect diseases faster, provide better-customized treatment plans, and even completely automate certain processes, such as drug discovery or diagnostics. With such limitless potential, artificial intelligence is sure to illustrate a future filled with advancements, enhanced health outcomes, and optimized patient experiences.

How can Fingent Help Leverage AI for Better Healthcare Services?

Fingent is a top-notch technology solution provider with around 800+ successful projects. We have loyal clients across four continents. With our custom software development experts, you can develop intricate, truly innovative, AI-powered, custom healthcare software applications. These applications will give you a competitive advantage, ample time-to-market, ROI, and clinical precision.

We have positive feedback and strong bonds with an eminent list of healthcare clients, including the NHS, Novita Healthcare, Mundipharma, and Casenet, LLC, among others. As the world progresses forward with artificial intelligence, it is time for you to choose the right technological partner for this journey. Contact our experts today to discuss your AI project now!

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Maximize productivity and minimize uncertainty! That’s what Artificial Intelligence promises the Supply Chain and Logistics industry. The fragility of the supply chain is not unknown to industries. Delays, stoppages, and complexities in the supply chain are a few limitations businesses are striving to overcome. Operational efficiency, intelligent decision-making, and continuous improvement must be maximized. Thankfully, AI helps do just that. This blog will take you through the top benefits businesses can derive with AI in Supply Chain!

Why Is Now the Best Time for Supply Chain and Logistic Firms to Adopt AI?

The global trade scene and geopolitical risks have not been kind to the supply chain. A 2023 Annual Supply Chain Report revealed that events around the world continue to have a detrimental impact on it. These include political upheavals, climate-related events, supply chain legislation, and more. Internally, there are issues to deal with as well. A lack of governance and data management, labor strikes, and communication hurdles have proved challenging.

Not everything is bad news, though. These harsh conditions have built resilience and determination in supply chain and logistics organizations worldwide. A 2024 KPMG study of supply chain trends says: “Enabled with a raft of technology developments, a new paradigm is emerging in supply chain management. One where organizations can respond quicker to day-to-day requests, proactively address problem-solving, and reduce errors and inefficiencies.”

Businesses are becoming wise to the situation and are reaping benefits. According to a McKinsey report, leveraging AI has helped businesses enhance logistics costs by 15%.

AI helps companies gain a unique competitive advantage in supply chain management and logistics operations. It can install advanced algorithms and large-scale data analytics as an emerging technology. This simplifies supply chain workflows and boosts decision-making processes. Some other perks of leveraging AI-powered technologies are accurate forecasting, inventory management, optimization of transportation functions, improvement of flexibility and agility, and enhancement of customer satisfaction. These are all the ingredients you need to get your supply chain processes back on track.

The time to build resilience with the help of technology is NOW!

Explore More Business Opportunities With Artificial Intelligence

What Are the Top Benefits of Using AI in the Supply Chain?

AI can bring operational efficiency, on-time delivery, accurate predictions, risk management, and more to the supply chain and logistics management. Here are the top benefits industries can reap by deploying AI for logistics.

1. Reduced Cost

AI has the power to automate tasks. This gives a power boost to the human workforce. . It frees them up for higher-value activities and takes over the burden of mundane labor. This optimization of labor practices will reduce labor costs while increasing efficiency. AI-powered forecasting can help maintain optimal inventory levels, decreasing any risk of stock-outs and loss of sales. This directly contributes towards cost savings

2. On-Time Delivery

AI systems can process large amounts of data in real time. It can recognize patterns, enhance inventory levels, and accurately predict demand. This predictive ability ensures on-time delivery, thus enhancing operational efficiency. Generative AI can use algorithms to analyze transportation routes and optimize logistics scheduling. This will, in turn, improve delivery times and reduce fuel consumption and transportation costs. Another major benefit is real-time tracking and updates on orders. This provides transparency with customers that will increase their confidence and satisfaction.

3. Accurate Management And Planning

Predicting future demands is vital for effective stock and product management. AI algorithms can forecast product demand for specific seasons of the year. This enables companies to make well-informed decisions about managing inventory. As for logistics firms, AI can enhance supply planning. By analyzing factors such as production schedules, sales data, and costs. This analysis helps businesses to plan warehouse functions. This includes managing stock levels and surplus inventory. Thus reducing costs and providing control over expenses. A survey by McKinsey showed a reduced cost expense of 15% in logistics management. Early adopters of AI-powered supply chain management saw this change.

4. Risk Management

Leveraging AI for supply chain management and logistic operations can reduce risk. AI bots can be used effectively in this regard. They do this with the application of advanced analytics and scenario modeling. This enables businesses to create complex contingency plans and adapt risk mitigation strategies. Generative AI measures the impact of any chain of damage. This will, in turn, allow companies to respond and use effective mitigation strategies. AI-powered supply chain monitoring tools work together to identify any risks. Early detection alarms, for example, enable timely intervention and reduce impact on performance.

AI Use Cases In Logistics

Artificial Intelligence controls data and uses machine learning to optimize the flow of goods. With algorithms to identify patterns, relationships, and trends, AI enables accurate predictions and recommendations. Here are some use cases to show how this can help businesses:

1. Bullwhip Effect Prevention

A small change in demand can create catastrophic ripples across the supply chain. Effective demand forecasting helps mitigate this bullwhip effect. Demand forecasting utilizes predictive analytics to estimate customer demand forecasts. It does this by analyzing historical data in real-time. With this method, businesses can improve their decision-making processes and workforce planning. Thus, AI-powered demand forecasting can reduce error rates, leading to improved accuracy in demand prediction. Manufacturers can manage every little detail, like the number of vehicles dispatched, and thus reduce operational costs.

According to a Gartner study, demand forecasting is the most used ML application in supply chain planning. The study also highlighted that 45% of businesses have already implemented this technology, and 43% plan to use it within the next two years.

2. Automation Warehousing

Reports estimate the warehouse robotics market will reach USD 10.5 billion by 2028, accompanied by a CAGR of 11.4% during the forecasting period. The need for operational quality is the fueling force that drives this growth. Amazon is a great example of this change. The giant retail company Amazon has close to 200,000 robots functioning in its warehouses. These robots help employees pick, sort, transport, and stow packages.

Computer vision technology allows businesses to identify damaged goods. This ensures quality control in warehouse operations. Logistics managers can also regulate the size and type of damage. This will help them take appropriate action. Predictive maintenance is another technology that is very beneficial to a company warehouse. It can predict machine failures in the factory. It does this by processing real-time data gathered from the IoT sensors.

3. Back Office Management

Every company has a back office that handles the brunt of the workflow. It manages largely repetitive tasks, including bill of lading, invoice maintenance, document processing, and customer services. AI can transform these processes into simpler tasks.

An example is the invoice of rate sheet documents. They manage communication within the workspace. With the help of AI, this process can be automated and made efficient. Accurate data input, error reconciliation, and document processing make this possible. Hyperautomation can help here as well. It combines Artificial Intelligence with robotic process automation and process mining. Together, they make the automation process seamless.

Customer service chatbots analyze customer experience with chatbot analytics metrics. This helps them understand the customer’s needs and respond accordingly, leading to higher customer satisfaction rates.

4. Sales & Marketing

Predictive lead scoring is a subfield of AI and is invaluable to the sales function. It uses machine learning to calculate a score for open leads based on historical data. Lead scoring will ensure that sales reps can focus on the right prospects for the company. This AI-powered tool can assign appropriate scores to leads based on their profile, behavior, and interests. These algorithms can process data. Thus, they can predict which leads will convert into paying customers.

AI can also analyze sales and marketing. With the help of AI-powered tools, logistics service providers can process customer behaviors. This helps them predict the customer’s next move. They can also track fluctuations in the market, enabling logistics service providers to be alert and make data-driven decisions.

Reshape Customer Experiences with AI & ML

What Are the Top Trends in AI for Supply Chain?

IoT, Hyper-Personalization, Robotics, and Natural Language Processing are some of the top trends businesses can expect to see and implement going forward. Here are the details:

1. Better Integration With The Internet Of Things (IoT)

Internet of Things (IoT) devices allow for real-time tracking of products in a supply chain. When combined with advanced AI technology, they can perform a wide range of tasks. These tasks include optimization of routes, reducing delays, and enhancing supply chain management.

New technologies, such as digital twins, will allow companies to develop a digital model of the product. This can help companies create a virtual representation of their supply chain model. Drones are also equipped with IoT sensors to test deliveries. Studies estimate that around 70% of urban deliveries are drone-based package delivery networks.

2. Autonomous Supply Chain Systems And Robotics

A 2023 Gartner study predicts that 75% of companies will install cyber-physical automation in their warehouse operations by 2027. The use of robotics and AI-driven systems will streamline the warehouse processes, thus reducing reliance on labor and resources.

Some companies, like Amazon, have already installed autonomous mobile robots (AMRs). In the future, many more companies will follow suit, and we can expect to see AMR technology bloom. These autonomous robots will have systems working 24/7, thus implementing a higher level of quality and productivity.

3. AI-Driven Hyper-Personalization Of Service

The increased priority to customer service is a trend seen throughout innumerable industries. AI can help with this by analyzing customer data and preferences. Businesses can better curate their services to personalized needs. With the introduction of AI, hyper-personalization will grow further. It will encourage manufacturing managers to leverage Machine learning. This will automate manufacturing adjustments that will, in turn, improve customer experience. According to reports, AI-driven forecasting can improve supply chain resilience. It has the potential to reduce stockouts by 50%.

4. Adoption Of Advanced AI Technologies (NLP, Annss)

More and more companies will recognize the potential of high-level AI systems. They will rely on Machine Learning, deep learning, and natural language processing. We will see a rise in data analytics quality and, by extension, better decision-making.

Machine Language has an unparalleled ability to process large amounts of data to recognize trends. It will improve accuracy when it intercedes with forecasting inventory needs.

Artificial Neural Networks (ANNSs) are subfields of AI that use deep learning and ML. They detect anomalies and predictive maintenance needs. NPL will also play a big role in enhancing workflow. Thus improving communication between team members, employees, and machines.

How Can Fingent Help Future-Proof Your Supply Chain And Logistics Firms With AI?

At Fingent, we recognize and understand AI’s transformative power. We expertly maneuver its ability to optimize your supply chain and offer curated custom logistics software development services. Experts at Fingent understand what is needed to implement AI solutions effectively for your business. They specialize in AI technologies like Machine Learning, Natural Language Processing, and Robotic Process Automation. We can thus help you tap into the latest advancements in technology.

When you work with Fingent, you get a dedicated team of experienced professionals who can guide you with expertise in logistics management and advanced AI services. Connect with us today to develop customized solutions for streamlined operations, seamless processes, and competitive advantage.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

How can a custom payment processing solution change your business?

The benefits are many: streamlined payment processes, safe transactions, easy fraud detection, and better customer experience. However, you might wonder why choose a customized solution when ready-made software can easily fetch these advantages. Tailor-built applications can do more! They offer seamless integrations, personalization, scalability, and distinct solutions that cater to your unique business needs.

In this five-minute read, you’ll find more about why you implement a custom payment processing solution for your business!

What Business Challenges Do Payment Processing Systems Alleviate?

1. Late Payments

Late payments pose a persistent challenge for enterprises. They puncture cash flows and strain client relationships. Custom payment processing solutions tackle this issue. Automated invoicing, recurring billing, and payment reminders help ensure timely payments. Streamlining payment collection enhances cash flow management, mitigating delays and improving financial planning.

2. Manual Mishaps

Manual glitches in payment processing are a hassle. They can brood discrepancies in financial logs and regulatory tangles. Custom solutions harness automation to excise manual data input. This helps in seamlessly integrating with accounting frameworks and ERP software. This, in turn, ensures precision and uniformity in financial dealings. It also economizes time and resources while enhancing accuracy.

3. Security Concerns

Security is crucial when handling payments. With cyber-attacks increasing each year, protecting payment information is critical. Customized solutions enable security measures like tokenization, encryption, and following PCI compliance rules. These protections help keep payment data safe during transactions. They also reduce the risk of fraud or identity theft, which makes customers feel more confident about using the service.

4. Lack of Integration

Fusing payment processing systems with existing infrastructure poses a puzzler for enterprises. Customized solutions are architected to blend seamlessly with various business systems, including CRM platforms and e-commerce portals. This amalgamation streamlines operations, heightens visibility, and enhances decision-making processes.

A Unified Self-service Customer Portal Transforming Payment Experience

What Are the Top Benefits of Payment Processing Solutions?

Let’s now unveil the metamorphic might of payment processing solutions. More importantly, see their potential to revolutionize enterprise financial functions.

1. Cash Flow Augmentation

Efficient payment processing bolsters cash flow by automating invoicing, payment collection, and reconciliation. Timely payments ensure a steady fund inflow. This is important in meeting fiscal commitments, investing, and sustaining liquidity.

2. Security Supremacy

Payment processing solutions ensure robust security, including encryption, fraud detection, and safeguarding sensitive data. Adherence to standards like PCI DSS fosters trust among customers and stakeholders.

3. Client Contentment

Frictionless payment encounters amplify client satisfaction and allegiance. Various payment alternatives, secure checkouts, and instantaneous confirmations ensure this. They truncate friction and amplify repeat transactions.

4. Reporting and Analytics

Access to real-time data and analytics catalyzes informed decision-making. Insights into transaction volumes, trends, and consumer conduct empower enterprises. They can pinpoint growth prospects and fine-tune strategies.

Why Choose Custom Over Off-the-Shelf?

Businesses frequently grapple with the choice between off-the-shelf and custom payment processing solutions. Granted, off-the-shelf options provide convenience and cost-effectiveness. However, they may fall short of meeting unique organizational needs. In contrast, custom solutions are crafted to fit specific requirements, offering unmatched advantages.

Custom payment processing solutions allow for flexibility and scalability. They empower enterprises to adapt and evolve in the face of fluctuating market dynamics and consumer demands.

Custom solutions provide unmatched flexibility to accommodate singular business processes and demands. They employ personalized workflows, user interfaces, and integrations with extant systems and third-party applications. Custom solutions harmonize these tools with organizational aspirations and priorities. This optimizes efficiency, augments productivity, and catalyzes innovation across the payment realm.

Limitations of Off-the-Shelf Solutions

Off-the-shelf solutions may seem like a quick and cost-effective way to get started, but they often come with limitations, especially in terms of functionality, customization options, and scalability. Businesses may find themselves constrained by rigid workflows and limited integration capabilities. Support for specialized payment methods or industry-specific requirements isn’t provided, either. Reliance on third-party vendors for updates, upkeep, and support can be a hassle. It can engender dependency dilemmas and potential hiccups in business operations.

On the other hand, custom payment processing solutions remove this element. They offer greater sway, flexibility, and ownership over the payment setting. They help enterprises optimize processes, strategically innovate, and stay ahead of the curve.

Deliver Top-Notch Banking Experiences to Your Customers!

How Do I Strategize A Custom Payment Processing Solution?

Let’s explore the strategic blueprint behind crafting custom payment processing solutions. Also, take a look at how they cater to unique business requirements:

1. Understanding Business Requirements

Businesses must first grasp their specific needs and objectives. A thorough analysis of current processes, pain points, and future goals is key. A deep understanding of business requirements is essential here. Whether its optimizing invoice management, enhancing security protocols, or integrating with existing systems.

2. Scalability and Flexibility

In today’s dynamic business landscape, scalability and flexibility are crucial. This holds true in a custom payment processing solution as well. Priorities are accommodating increasing transaction volumes, expanding product lines, and evolving business models. Adopting scalable architecture and flexible design principles can future-proof the payment processing ecosystem.

3. Compliance and Security

Compliance and security are paramount in financial transactions. A custom payment processing solution should adhere to regulatory requirements, including PCI DSS, GDPR, and industry-specific standards. Robust security measures such as encryption and multi-factor authentication are vital. They safeguard sensitive payment data and mitigate the risk of fraud and data breaches.

4. User Experience

User experience (UX) is critical for the success of any payment processing system. A seamless and intuitive user interface is important. This, coupled with streamlined workflows and clear communication, enhances usability and efficiency. Prioritizing UX can help in many ways. Organizations can improve adoption rates, reduce user errors, and enhance customer satisfaction.

How Can Fingent Help?

Fingent specializes in crafting custom software solutions. This includes personalized payment processing systems tailored to our client’s unique requirements. We have extensive experience in the field. Streamlining payment operations, bolstering security, and fostering business growth are our forte.

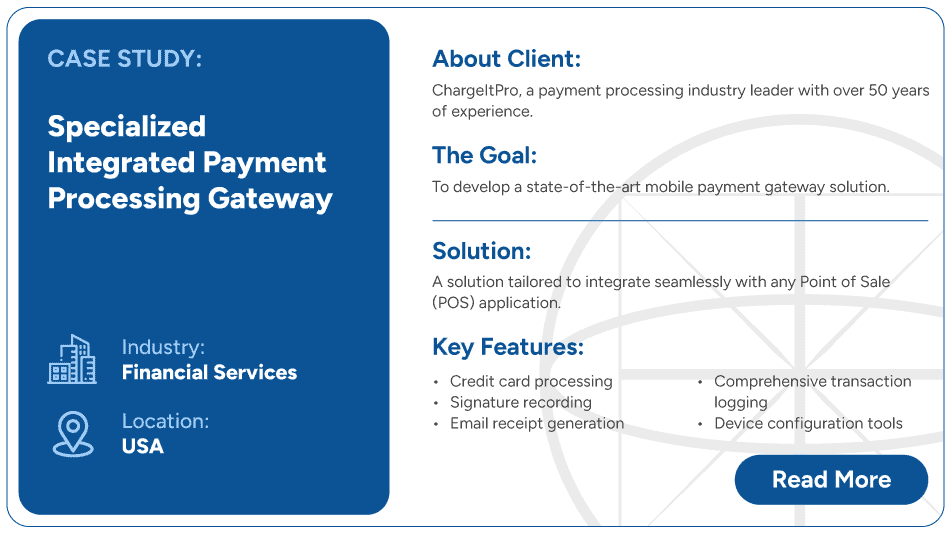

Our approach starts with a deep dive into our clients’ needs, objectives, and challenges. We work closely with stakeholders to get the complete picture. We gather insights, pinpoint pain points, and establish success metrics. Experts are handpicked, drawing on our technical expertise and industry knowledge. We then design and develop bespoke solutions that precisely address our clients’ needs. Consider this case study:

These features enable effortless payment experiences for customers, ensuring security and reliability. This collaboration exemplifies Fingent’s commitment to delivering innovative custom software solutions. Our strength is in tailoring these solutions to meet the unique needs of our customers.

Get Custom, Get Smart!

Payment processing systems tackle vital business challenges like late payments and manual errors. This is achieved through customized solutions for improved cash flow and enhanced security. Strategic planning and choosing the right partner are key.

Leverage Fingent’s expertise! Transform your payment processes and unlock new opportunities for success. See how our custom software solutions can empower your organization to thrive in the digital economy. Contact us today.

Stay up to date on what's new

Featured Blogs

Stay up to date on

what's new

Talk To Our Experts

Achieving perfection is no easy process. It is not impossible either. It takes a lot of effort and hard work but with the help of Artificial Intelligence, this process can become a lot smoother. AI has undoubtedly proved itself in innumerable industries, and the financial market is no different.

With AI, Financial sectors are seeing a massive transformation in how they work, process documents, make decisions, predict market changes, and even mitigate risks.

As Dan Schulman, the CEO of PayPal once said, “We’re not trying to reinvent the wheel; we’re trying to perfect it.”

In this blog, we will learn how Artificial intelligence is shaping the future of financial services.

What Does Artificial Intelligence Mean to the Financial Service Sector?

First, it’s imperative to understand the relationship between Artificial intelligence and finance. Almost all major banks state that they use AI for various functions. It supports financial services like automated customer assistance, risk management, and fraud detection. Research shows that machine learning makes up about 18% of the banking, financial services, and insurance market.

With the assistance of AI, banks can perform a wide range of functions, including real-time performance forecasting, detection of odd spending patterns, and compliance management. This enables them to streamline and automate mundane manual processes and boost efficiency.

With machine learning, AI can evaluate large amounts of data to discover trends and form predictions. This allows investors to track investment growth and beware of risks.

A Comprehensive Guide: Leader’s Blueprint For AI Success