Custom Payment Processing Solution: A Game Changer For Your Business

How can a custom payment processing solution change your business?

The benefits are many: streamlined payment processes, safe transactions, easy fraud detection, and better customer experience. However, you might wonder why choose a customized solution when ready-made software can easily fetch these advantages. Tailor-built applications can do more! They offer seamless integrations, personalization, scalability, and distinct solutions that cater to your unique business needs.

In this five-minute read, you’ll find more about why you implement a custom payment processing solution for your business!

What Business Challenges Do Payment Processing Systems Alleviate?

1. Late Payments

Late payments pose a persistent challenge for enterprises. They puncture cash flows and strain client relationships. Custom payment processing solutions tackle this issue. Automated invoicing, recurring billing, and payment reminders help ensure timely payments. Streamlining payment collection enhances cash flow management, mitigating delays and improving financial planning.

2. Manual Mishaps

Manual glitches in payment processing are a hassle. They can brood discrepancies in financial logs and regulatory tangles. Custom solutions harness automation to excise manual data input. This helps in seamlessly integrating with accounting frameworks and ERP software. This, in turn, ensures precision and uniformity in financial dealings. It also economizes time and resources while enhancing accuracy.

3. Security Concerns

Security is crucial when handling payments. With cyber-attacks increasing each year, protecting payment information is critical. Customized solutions enable security measures like tokenization, encryption, and following PCI compliance rules. These protections help keep payment data safe during transactions. They also reduce the risk of fraud or identity theft, which makes customers feel more confident about using the service.

4. Lack of Integration

Fusing payment processing systems with existing infrastructure poses a puzzler for enterprises. Customized solutions are architected to blend seamlessly with various business systems, including CRM platforms and e-commerce portals. This amalgamation streamlines operations, heightens visibility, and enhances decision-making processes.

A Unified Self-service Customer Portal Transforming Payment Experience

What Are the Top Benefits of Payment Processing Solutions?

Let’s now unveil the metamorphic might of payment processing solutions. More importantly, see their potential to revolutionize enterprise financial functions.

1. Cash Flow Augmentation

Efficient payment processing bolsters cash flow by automating invoicing, payment collection, and reconciliation. Timely payments ensure a steady fund inflow. This is important in meeting fiscal commitments, investing, and sustaining liquidity.

2. Security Supremacy

Payment processing solutions ensure robust security, including encryption, fraud detection, and safeguarding sensitive data. Adherence to standards like PCI DSS fosters trust among customers and stakeholders.

3. Client Contentment

Frictionless payment encounters amplify client satisfaction and allegiance. Various payment alternatives, secure checkouts, and instantaneous confirmations ensure this. They truncate friction and amplify repeat transactions.

4. Reporting and Analytics

Access to real-time data and analytics catalyzes informed decision-making. Insights into transaction volumes, trends, and consumer conduct empower enterprises. They can pinpoint growth prospects and fine-tune strategies.

Why Choose Custom Over Off-the-Shelf?

Businesses frequently grapple with the choice between off-the-shelf and custom payment processing solutions. Granted, off-the-shelf options provide convenience and cost-effectiveness. However, they may fall short of meeting unique organizational needs. In contrast, custom solutions are crafted to fit specific requirements, offering unmatched advantages.

Custom payment processing solutions allow for flexibility and scalability. They empower enterprises to adapt and evolve in the face of fluctuating market dynamics and consumer demands.

Custom solutions provide unmatched flexibility to accommodate singular business processes and demands. They employ personalized workflows, user interfaces, and integrations with extant systems and third-party applications. Custom solutions harmonize these tools with organizational aspirations and priorities. This optimizes efficiency, augments productivity, and catalyzes innovation across the payment realm.

Limitations of Off-the-Shelf Solutions

Off-the-shelf solutions may seem like a quick and cost-effective way to get started, but they often come with limitations, especially in terms of functionality, customization options, and scalability. Businesses may find themselves constrained by rigid workflows and limited integration capabilities. Support for specialized payment methods or industry-specific requirements isn’t provided, either. Reliance on third-party vendors for updates, upkeep, and support can be a hassle. It can engender dependency dilemmas and potential hiccups in business operations.

On the other hand, custom payment processing solutions remove this element. They offer greater sway, flexibility, and ownership over the payment setting. They help enterprises optimize processes, strategically innovate, and stay ahead of the curve.

Deliver Top-Notch Banking Experiences to Your Customers!

How Do I Strategize A Custom Payment Processing Solution?

Let’s explore the strategic blueprint behind crafting custom payment processing solutions. Also, take a look at how they cater to unique business requirements:

1. Understanding Business Requirements

Businesses must first grasp their specific needs and objectives. A thorough analysis of current processes, pain points, and future goals is key. A deep understanding of business requirements is essential here. Whether its optimizing invoice management, enhancing security protocols, or integrating with existing systems.

2. Scalability and Flexibility

In today’s dynamic business landscape, scalability and flexibility are crucial. This holds true in a custom payment processing solution as well. Priorities are accommodating increasing transaction volumes, expanding product lines, and evolving business models. Adopting scalable architecture and flexible design principles can future-proof the payment processing ecosystem.

3. Compliance and Security

Compliance and security are paramount in financial transactions. A custom payment processing solution should adhere to regulatory requirements, including PCI DSS, GDPR, and industry-specific standards. Robust security measures such as encryption and multi-factor authentication are vital. They safeguard sensitive payment data and mitigate the risk of fraud and data breaches.

4. User Experience

User experience (UX) is critical for the success of any payment processing system. A seamless and intuitive user interface is important. This, coupled with streamlined workflows and clear communication, enhances usability and efficiency. Prioritizing UX can help in many ways. Organizations can improve adoption rates, reduce user errors, and enhance customer satisfaction.

How Can Fingent Help?

Fingent specializes in crafting custom software solutions. This includes personalized payment processing systems tailored to our client’s unique requirements. We have extensive experience in the field. Streamlining payment operations, bolstering security, and fostering business growth are our forte.

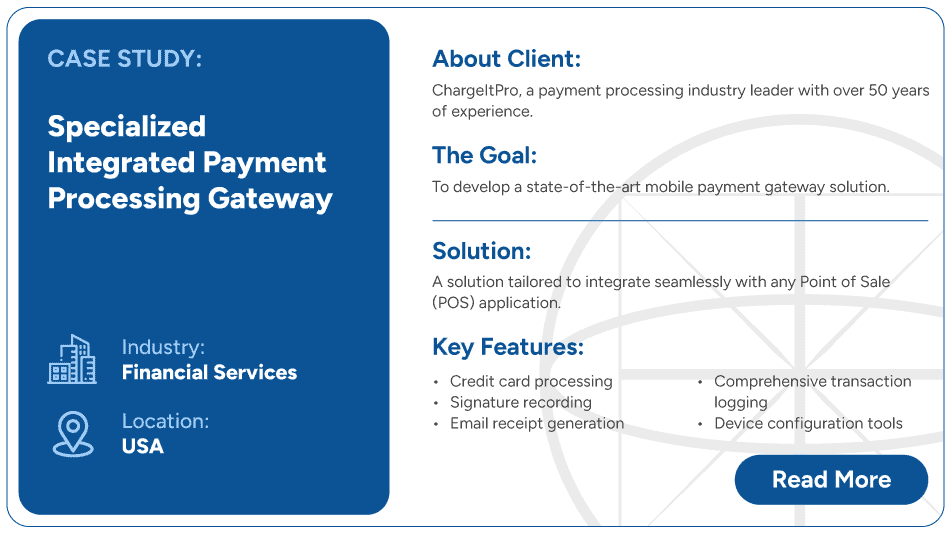

Our approach starts with a deep dive into our clients’ needs, objectives, and challenges. We work closely with stakeholders to get the complete picture. We gather insights, pinpoint pain points, and establish success metrics. Experts are handpicked, drawing on our technical expertise and industry knowledge. We then design and develop bespoke solutions that precisely address our clients’ needs. Consider this case study:

These features enable effortless payment experiences for customers, ensuring security and reliability. This collaboration exemplifies Fingent’s commitment to delivering innovative custom software solutions. Our strength is in tailoring these solutions to meet the unique needs of our customers.

Get Custom, Get Smart!

Payment processing systems tackle vital business challenges like late payments and manual errors. This is achieved through customized solutions for improved cash flow and enhanced security. Strategic planning and choosing the right partner are key.

Leverage Fingent’s expertise! Transform your payment processes and unlock new opportunities for success. See how our custom software solutions can empower your organization to thrive in the digital economy. Contact us today.

Stay up to date on what's new

Recommended Posts

20 Aug 2024 B2B

Legacy Software Modernization: An Inevitable Path For Businesses

Wine and wisdom get better with age. But software doesn't. That's why experts say legacy software modernization is inevitable for modern businesses. Picture this! Ten years ago, you might have……

18 Jan 2024

Why Are Leading Businesses Prioritizing Application Modernization

“In Today’s era of volatility, there is no other way but to re-invent. The only sustainable advantage you can have over others is agility, that’s it. Because nothing else is……

20 Dec 2023 B2B

Driving Smart and Sustainable Agriculture with Customized Technology!

As the world grapples with the challenges of climate change, soil degradation, and resource scarcity, agricultural organizations find themselves at a critical juncture. The urgency for adopting sustainable farming practices,……

03 Oct 2023 B2B

Is It Time For Your Business To Think Beyond Home-grown Software Solutions?

Home-grown might be the way to go when it’s to be put on your dinner table, but does it apply to your business as well? The need for complete digitization……

Featured Blogs

Stay up to date on

what's new